- Nvidia is facing significant challenges despite high demand for its new RTX 5090 and 5080 graphics cards.

- Manufacturing issues have led to product shortages, causing frustration among consumers and allowing scalpers to inflate prices.

- The company is struggling to align production with the high demand in the market.

- Emerging competition, particularly from DeepSeek’s AI model, poses a serious threat to Nvidia’s market dominance.

- Potential tariffs on imported chips threaten Nvidia’s profitability and may lead to increased consumer prices.

- These developments reflect the volatility of the tech industry, emphasizing that even leading companies can face instability.

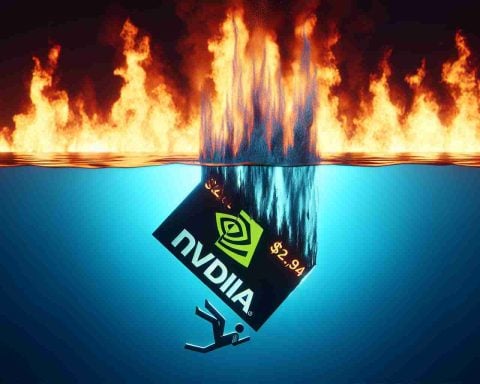

Nvidia is caught in a storm of challenges that threaten to unravel its recent triumphs, even as it unveils its highly anticipated RTX 5090 and 5080 graphics cards. Despite soaring demand, shoppers are left frustrated—retail shelves are empty, and pre-orders are met with promises of weeks, if not months, of delay. The reason? Nvidia’s manufacturing issues, which have hampered production and allowed scalpers to cash in with outrageous price marks.

While it’s clear that demand for the RTX series is roaring, the supply chain has crumbled, preventing Nvidia from capitalising on this eager market. This misalignment could signify a worrisome trend for investors as Nvidia struggles to bridge the gap between eager buyers and limited stock.

To make matters worse, the release of DeepSeek’s advanced AI model casts a daunting shadow over Nvidia’s market position. This China-based startup has unveiled a system rivaling those of leading U.S. companies, created with a fraction of the funding and resources. The implications are stark: as competition intensifies, Nvidia may find its dominance threatened in the rapidly evolving AI landscape.

Adding to the turbulence, President Trump’s announcement of potentially steep tariffs on imported chips could further strain Nvidia’s profitability. As companies brace for rising costs, it’s consumers who might pay the price, facing inflated prices for essential tech.

Takeaway: Nvidia’s latest struggles highlight the precarious balance in the tech industry—where innovation meets market unpredictability—and serve as a stark reminder that even giants can stumble. Stay informed and keep an eye on the unfolding drama!

Can Nvidia Overcome Its Supply Chain Woes and Emerging Competition?

Nvidia is currently facing a multitude of challenges that threaten to undermine its recent success, especially with the recent launch of the RTX 5090 and 5080 graphics cards. Despite an overwhelming demand for these new products, consumers are grappling with empty retail shelves and long pre-order wait times due to significant manufacturing and supply chain issues. The situation has been exacerbated by the actions of scalpers, who are capitalising on the shortages by reselling cards at exorbitant prices.

Market Forecasts

The demand for Nvidia’s RTX series indicates a booming market, but the compounded supply issues raise questions about future profitability. Analysts are predicting that unless manufacturing capabilities improve swiftly, Nvidia may not be able to meet the demands of consumers and could lose market share. In addition, the potential tariffs on imported chips could add to production costs, pushing retail prices even higher.

Compare & Contrast

Nvidia vs. DeepSeek: While Nvidia has long been an industry leader in graphics and AI technology, the emergence of DeepSeek—a China-based competitor—poses a serious threat. DeepSeek has managed to develop a competitive AI model with significantly lower funding, showcasing that innovation is not limited to traditional powerhouses. This competition could erode Nvidia’s market dominance, forcing it to innovate at an accelerated pace while managing its supply chain issues.

Pros and Cons

Pros:

– Nvidia’s RTX 5090 and 5080 graphics cards boast advanced performance capabilities, appealing to gamers and professionals alike.

– The company still holds a strong brand reputation and loyal customer base.

Cons:

– Significant supply chain disruptions are hindering availability.

– Emerging competition from startups like DeepSeek could erode Nvidia’s market position.

– Potential trade tariffs threaten to increase operational costs and affect pricing.

Use Cases

The RTX series is ideal for applications ranging from high-end gaming to professional graphics rendering and artificial intelligence computations. Users across various sectors, including content creation and AI research, are expected to demand these graphics cards upon release.

Limitations

While the RTX graphics cards promise unparalleled performance, the current shortages and resale prices could limit access for average consumers, leading to a potential market backlash. The company’s ability to scale production in light of existing supply issues will determine its future success.

Pricing Trends

As demand continues to surge, coupled with limited supply due to manufacturing challenges, prices for the newest RTX cards are likely to remain elevated. Consumers are advised to monitor prices closely, as market dynamics could fluctuate rapidly.

Insights and Innovations

Nvidia remains a leading innovator in graphics technology and AI applications. However, the company must prioritise resolving its manufacturing and supply chain issues to maintain its competitive edge. The recent advancements from competitors highlight the necessity for Nvidia to keep evolving.

Frequently Asked Questions

1. What are the main challenges Nvidia is facing currently?

Nvidia is grappling with manufacturing and supply chain issues leading to empty shelves and delayed shipments of its new RTX graphics cards. Additionally, emerging competition from companies like DeepSeek and potential tariffs on chips pose further challenges.

2. How does DeepSeek affect Nvidia’s market position?

DeepSeek’s successful launch of a competitive AI model with minimal resources poses a direct challenge to Nvidia’s market dominance, potentially attracting customers away from Nvidia’s established products.

3. What impact will tariffs on imported chips have on consumers?

The proposed tariffs could increase production costs for Nvidia, likely resulting in higher retail prices for consumers and fewer purchasing options due to pricing constraints.

For more information, visit Nvidia’s official site.