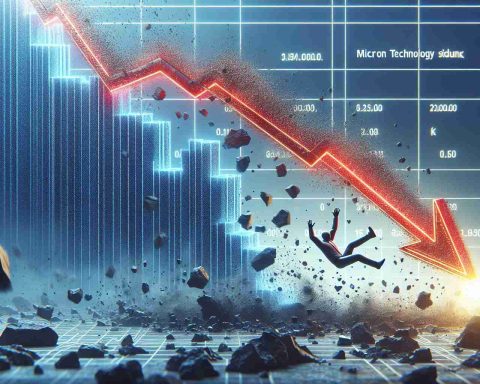

In a strategic move that underscores confidence in the semiconductor industry, Prime Capital Investment Advisors LLC has significantly boosted its stake in Micron Technology, Inc. The firm increased its holdings by an impressive 21.5% during the third quarter, as detailed in their latest filing with the Securities and Exchange Commission. This increase brings their ownership to 45,403 shares, valued at a notable $4.7 million.

Prime Capital isn’t alone in its optimism. Several other financial institutions have also adjusted their stakes in Micron. Private Management Group Inc. and TBH Global Asset Management LLC each acquired new positions in the company earlier this year, while Beacon Investment Advisory Services Inc. and Midwest Professional Planners LTD. expanded their existing stakes.

Micron’s stock continues to attract strong interest, with 80.84% of it owned by institutional investors and hedge funds. Analysts have shown a positive outlook, with many increasing their price targets. For instance, Bank of America increased its price objective from $110 to $125, reiterating a “buy” rating. Meanwhile, other analysts, like Cantor Fitzgerald, maintain even higher expectations with price targets reaching $150.

Micron’s stock performance reflects this confidence, recently opening at $104.10. With a market cap of $115.42 billion, the company’s financials show resilience and potential for growth, as evidenced by their latest earnings results. Looking ahead, sell-side analysts predict continued favorable results, projecting significant earnings per share for the fiscal year.

Could Micron Technology’s Growing Value Hold the Key to the Future of Semiconductors?

The soaring interest in Micron Technology, Inc. offers profound insights into the broader semiconductor industry, affecting economies and societies on multiple fronts. But while institutional investors rally behind Micron, what are the broader implications for individuals, communities, and countries dependent on this industry?

Fascinating Industry Dynamics

The semiconductor industry, increasingly seen as the backbone of modern technology, directly impacts sectors ranging from consumer electronics to defense. Micron Technology, as a leader in memory and storage solutions, plays a crucial role in this ecosystem. The company’s success indicates the growing demand for these technologies, driven by innovations like AI, 5G, and autonomous vehicles.

On a national level, the semiconductor sector is often viewed as a strategic industry. Countries investing heavily in semiconductor research and production, such as the United States, South Korea, and Taiwan, gain significant competitive advantages in global technology landscapes. Investments in companies like Micron can signal these countries’ priorities in maintaining technological leadership.

Advantages and Implications for Society

With technological advancements, communities benefit from improved access to faster and more efficient computing and connectivity solutions. This progress translates into enhanced healthcare technologies, smarter cities, and more efficient infrastructures. For instance, the development of AI-powered diagnostics machines and real-time data analytics systems relies heavily on advanced memory and storage solutions provided by companies like Micron.

On an industrial level, sectors relying on data processing and management see increased productivity and reduced operational costs. Companies that adopt cutting-edge semiconductor technologies can innovate faster and stay competitive, leading to job creation and economic growth.

Potential Drawbacks and Challenges

Despite the evident progress, dependence on a limited number of semiconductor manufacturers presents risks. Supply chain disruptions or political tensions can lead to shortages, as seen in recent global chip shortages affecting industries worldwide. These shortages can ripple through economies, causing delays and increasing costs for manufacturers and consumers alike.

Additionally, the environmental impact of semiconductor manufacturing is a growing concern. The industry is energy-intensive, and the production process involves significant resource use and waste generation. Addressing these environmental challenges is critical for sustainable growth.

Controversies and Ethical Questions

The semiconductor industry also faces privacy and security concerns. As memory and storage technologies enable vast data collection and storage, the potential for misuse or data breaches raises ethical and regulatory questions. Balancing technological advancements with privacy rights is crucial as societies navigate these challenges.

What Lies Ahead?

Will Micron Technology and its peers continue to meet global demands, or will emerging competitors and geopolitical factors disrupt this momentum? Can the industry overcome its environmental and ethical challenges to ensure sustainable growth? As these questions linger, the world watches closely, understanding that the answers will significantly influence the future trajectory of technology and society.

For those interested in exploring more about the semiconductor industry and its future, consider visiting Semiconductor Industry Association and EE Publishers.