- Supermicro, a key player in AI and technology, faced significant turmoil yet has shown resilience.

- The company’s stock soared nearly 800% due to its critical role in AI data centers, powered by Nvidia chips.

- Challenges arose with accusations of accounting issues, delayed reports, and auditor resignation, risking Nasdaq delisting.

- Supermicro has overcome these challenges with new audited financials, regaining Nasdaq compliance.

- Despite improvements, the company still faces concerns over its internal controls.

- Supermicro is committed to system upgrades and staff training, indicating progress and remaining vulnerabilities.

- Investors face a decision: cautious waiting for stability versus bold investing amidst AI market growth.

- The company, poised for potential rewards, must navigate a balance of risk and vision for future success.

Supermicro, a company thriving at the intersection of artificial intelligence and cutting-edge technology, recently weathered a storm that threatened its very core. This underdog saga both illustrates resilience and poses a tantalizing question for investors seeking high-stakes gains.

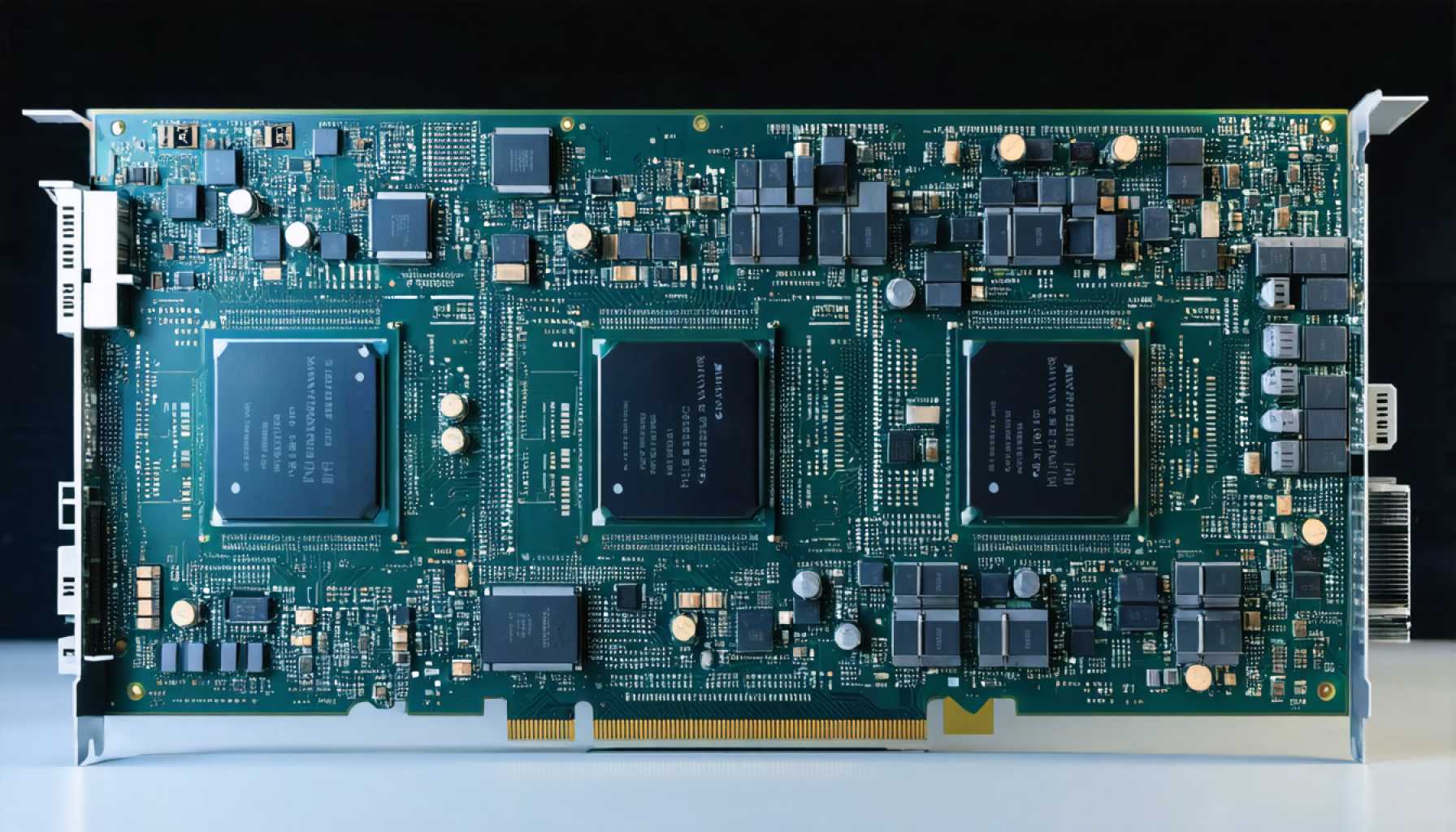

Picture Supermicro just a few years ago—its stock climbed with astonishing speed, surging nearly 800% as AI enthusiasts rushed to its doors. Their servers, snugly housing the latest chips from powerhouses like Nvidia, became the backbone for AI data centers worldwide. Supermicro was not merely participating in the AI boom; it was riding its crest.

Then came the turbulence. In a matter of months, accusations of “glaring accounting red flags” cast shadows over this once-shining star. A delayed 10-K report and the abrupt resignation of an auditor only deepened the gloom, culminating in the dread-inducing threat of a Nasdaq delisting.

Fast forward to today—a new chapter unfolds. Armed with audited financial reports and a clean bill from an independent oversight committee, Supermicro has dodged delisting. The Nasdaq’s judgment stands: compliant once more, the company grips its place on this storied exchange. Investors breathe a sigh of relief, and their confidence trickles back, albeit cautiously.

Yet, caution is warranted. Despite the recent successes, Supermicro still faces an “adverse opinion” of its internal controls. Committing to systems upgrades and staff training, the firm acknowledges the work ahead, signaling both a promise of improvement and a reminder of past vulnerabilities.

In this dynamic scene, is Supermicro worth the bet? For the cautious, perhaps not yet. The road ahead demands further proof of stability—a bolstered executive team and a string of robust financial statements could be key turning points.

However, for the bold investor, the untapped potential may be too tempting to resist. As the global AI market continues its relentless ascent—expected to catapult past $1 trillion by 2030—Supermicro’s renewed vigilance and domain expertise could unlock significant rewards.

The decision rests on a balance of risk and vision. Supermicro, forged anew by its trials, stands poised to reclaim its title. Whether it can once again dominate remains an alluring question, but one with the possibility of high stakes and high returns.

Is Supermicro a Smart Investment Amidst the AI Revolution?

Overview

Supermicro is a key player in the tech world, especially amidst the burgeoning field of artificial intelligence (AI). Navigating challenges such as accounting issues and the threat of delisting from Nasdaq, Supermicro has emerged stronger, signaling potential for growth in the ever-expanding AI market.

How Supermicro Thrived and Survived

– Explosive Growth: Supermicro’s stock once surged nearly 800%, mirroring the explosive growth in AI. Their servers power AI data centers, using advanced chips from companies like Nvidia.

– Accounting Turbulence: Accusations of accounting mismanagement, auditor resignation, and a threatened Nasdaq delisting shook the company.

– Regaining Compliance: With audited financial reports and oversight committee clearance, Supermicro retained its Nasdaq listing, restoring investor confidence.

– Challenges Remain: Despite overcoming past issues, Supermicro has received “adverse opinions” on its internal controls and acknowledges ongoing improvement needs.

Market Trends and Predictions

– AI Market Growth: The AI market is poised to exceed $1 trillion by 2030, opening vast opportunities for companies like Supermicro.

– Tech Industry Trends: The demand for high-performance data centers and AI infrastructure continues to grow, presenting potential growth avenues for server manufacturers.

– Competitors: Some of Supermicro’s competitors include Dell Technologies and Hewlett Packard Enterprise. Each offers unique advantages, with varying levels of scale, technology partnerships, and market reach.

Should You Invest in Supermicro?

– Pros:

– Positioned at the cutting-edge of AI technology.

– Re-established compliance with financial reporting standards.

– Strong partnerships with key technology firms, such as Nvidia.

– Cons:

– Previous accounting issues highlighting vulnerabilities in internal controls.

– Market uncertainty and volatility in technology stocks.

– Pressing Questions:

– How effectively can Supermicro enhance its internal controls?

– Will the company diversify its product offerings to reduce dependency on existing clients?

Actionable Recommendations

– Risk Assessment: Potential investors should proceed with caution, keeping an eye on Supermicro’s financial health and operational improvements.

– Diversification: Consider balancing investments in Supermicro with those in other tech stocks to mitigate risk.

– Monitor Quarterly Reports: Stay updated on Supermicro’s financial statements and strategic plans to gauge recovery progress.

For more information about trends and opportunities in the tech industry, visit Supermicro for updates on their services and products.

Conclusion

Supermicro’s journey illustrates resilience in the face of adversity. For those willing to embrace its risks, the company’s alignment with AI advancements presents tantalizing prospects for thriving in a trillion-dollar market. However, scrutinizing its operational developments and financial fortitude remains essential for informed decision-making.