- U.S. stock markets experienced a notable decline, with the S&P 500 and Nasdaq Composite each falling by about 2%, amid new tariff threats from President Trump.

- Trump’s proposed 25% tariffs on auto, chip, and pharmaceutical imports could potentially start in April, raising investor concerns.

- Investors focused on the Federal Reserve’s meeting minutes for guidance on future interest rates.

- Tech companies, including Microsoft and Apple, planned new product launches, while Etsy’s poor holiday sales affected its stock price.

- European markets also showed weakness due to ongoing tariff fears and disappointing earnings reports.

- Global markets mirrored geopolitical tensions, yet a resilient optimism persisted, as investors await further Fed insights.

- Despite market volatility, there remains cautious hope that the global economy can navigate current challenges.

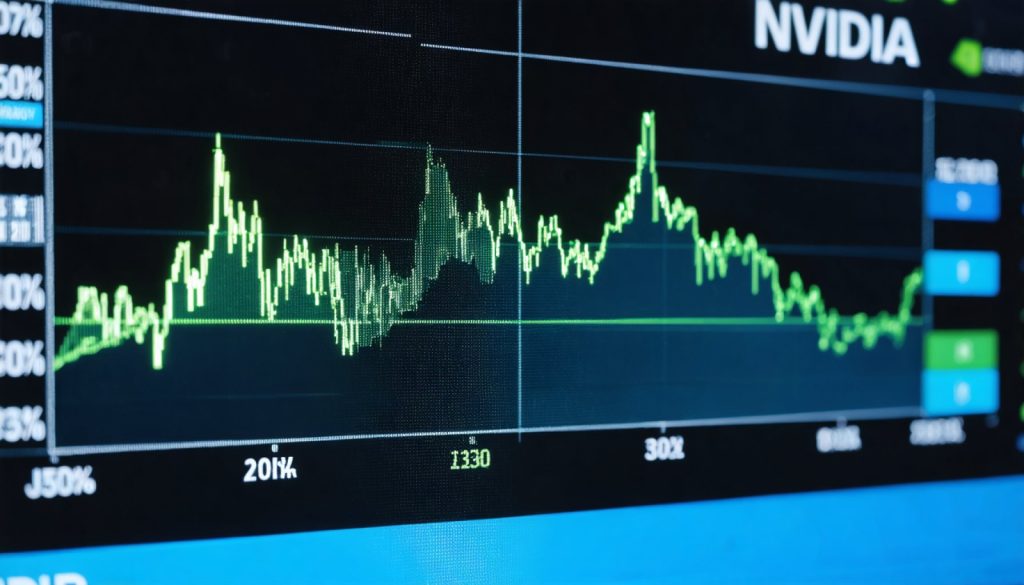

The financial world trembled slightly as U.S. stock markets slid, casting shadows over Wall Street with President Trump’s promise of fresh tariffs. The air was thick with anticipation on Wednesday, as investors scrutinized the chessboard shaped by policy maneuvers and waited for insights from the Federal Reserve’s latest meeting minutes. Anxiety flickered across screens as the S&P 500 and Nasdaq Composite each dipped by about 2%, while the Dow Jones nudged downward by 0.3%.

Eyebrows rose as fears circulated regarding Trump’s latest tariff salvo — a 25% levy on imports of autos, chips, and pharmaceuticals threatened to erupt as soon as April. Markets hesitated, caught in a tense wait-and-see dance, yet whispers of resilience wafted through. The S&P 500 had previously celebrated a record high, hinting at a stubborn optimism tethering investors even as clouds gathered.

Tech giants like Microsoft and Apple prepared to unveil new products, competing for attention alongside Etsy, whose disappointing holiday sales cast a chill, sending shares tumbling. Across the Atlantic, European stocks faltered too. Any euphoria from a blistering rally halted abruptly as skittishness over tariffs and dismal earnings derailed sentiment.

From Amsterdam to Tokyo, global markets echoed the tremors of a geopolitical landscape in flux. The essence of waiting, watching, and wagering defined this day on the exchanges, with investors balancing their hopes on what the Federal Reserve might illuminate about the future path of interest rates.

Bold gambits on the global scale may reshape the economic landscape, but today was encapsulated by watchful patience. Markets teeter on a precipice, yet the undertone of resilience suggests the world economy isn’t ready to concede defeat just yet.

How Tariff Tensions and Market Volatility Could Affect Your Portfolio in 2023

How-To Steps & Life Hacks

1. Diversify Your Portfolio: To minimize risk during volatile periods, consider spreading investments across different sectors and asset classes.

2. Stay Informed: Regularly check updates on tariffs and Federal Reserve policies which can impact market conditions.

3. Use Stop-Loss Orders: Protect your investments by setting stop-loss orders to automatically sell off stocks when they dip below a certain price.

4. Focus on Long-Term Growth: In times of market correction, maintain a long-term perspective to ride out short-term volatility.

Real-World Use Cases

– Corporate Strategy: Companies like Microsoft and Apple plan product launches strategically to offset market apprehensions, influencing their stock value amid economic tensions.

– Investing Tactics: Investors might prioritize sectors less affected by tariffs, such as utilities or consumer staples, to hedge against potential losses.

Market Forecasts & Industry Trends

– U.S.-China Trade Relations: Analysts predict continued tension with potential tariffs impacting tech and pharma sectors crucially, altering investment dynamics (source: Bloomberg).

– Fed Policy Impact: The Federal Reserve’s stance on interest rates is expected to influence stock market trends significantly throughout 2023.

Reviews & Comparisons

– Tech Stocks vs. Pharmaceuticals: While tech companies can often absorb tariff impacts through innovation, pharmaceuticals might face more substantial challenges due to international supply chains (source: Financial Times).

– Global Markets: European and Asian markets appear more sensitive to geopolitical shifts, making them riskier compared to the U.S. market.

Controversies & Limitations

– Tariff Efficacy: Critics argue that broad tariffs harm domestic industries and consumers, potentially leading to increased prices and lower economic growth (source: The Economist).

– Volatility: Market volatility can cause significant psychological stress to investors, impacting decision-making and leading to suboptimal trades.

Features, Specs & Pricing

– Product Releases: Companies such as Apple typically release new products to invigorate stock performance, often positively correlating with stock price spikes (source: Apple Investor Relations).

Security & Sustainability

– Economic Resilience: Despite immediate impacts, historical data suggests markets tend to recover from tariff-induced dips, showcasing a resilient economic foundation (source: World Economic Forum).

Insights & Predictions

– Short-Term Dips: Market analysts predict potential short-term declines due to tariff fears but emphasize the importance of monitoring Federal Reserve actions for clearer long-term predictions.

– Tech Innovation: Continued tech trends might mitigate some negative impacts of tariffs, driving growth in AI, cloud computing, and renewable energy sectors.

Tutorials & Compatibility

– Using Financial Tools: Platforms like Robinhood or E*TRADE offer tutorials for setting up diversified portfolios to buffer against volatile market trends.

– Tariff Impact Analysis: Learn to analyze how tariffs might impact specific investments using financial modeling apps.

Pros & Cons Overview

Pros:

– Long-term market resilience

– Opportunities in undervalued stocks

– Technological advancements

Cons:

– Immediate volatility

– Political and economic uncertainty

– Impact on consumer prices

Actionable Recommendations

– Reassess Risk Tolerance: Periodically review and adjust your risk tolerance to align with current market conditions and personal financial goals.

– Monitor Federal Policies: Stay updated on the Federal Reserve’s reports as changes in interest rates can have profound effects on investments.

– Consider Professional Guidance: Consulting with a financial advisor could offer strategic insights tailored to your unique situation.

For more insights and resources, visit Bloomberg or Wall Street Journal.