- Nvidia’s stock has dropped recently after an impressive 238% increase in early 2024, influenced by fears of new tariffs on Chinese imports.

- Despite challenges, Nvidia reported Q3 revenue of $35.08 billion, driven significantly by a 112% year-over-year growth in data centers.

- Analysts have a “Strong Buy” consensus on Nvidia, suggesting a potential 45% upside from current prices.

- Concerns about future revenue sustainability exist, particularly due to conservative projections for Q4.

- While disruptions may affect the supply chain, some experts view tariff fears as overblown, presenting buying opportunities.

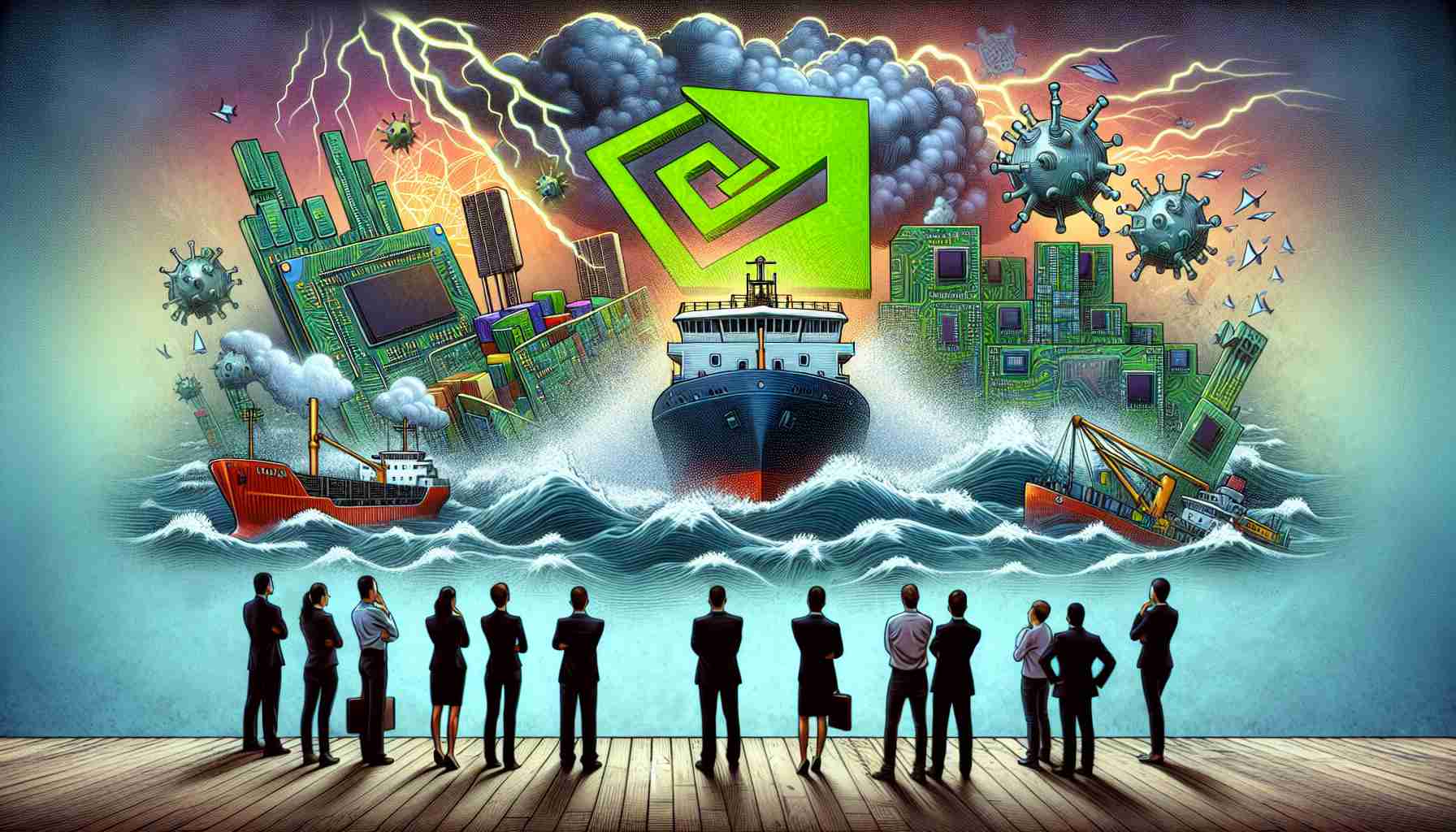

Nvidia, the powerhouse behind revolutionary GPUs, is navigating stormy waters as its stock experiences a downturn, driven by emerging challenges in the AI landscape and looming tariffs. In 2023 and early 2024, Nvidia stocks soared—an astonishing 238% increase—captivating investors. However, current fears surrounding the introduction of new tariffs, especially on Chinese imports, have cast a shadow over its performance.

While the semiconductor market seems largely insulated from direct impacts of tariffs, the indirect consequences loom large. With Foxconn eyeing a mega factory in Mexico to boost Nvidia’s GB200 chips, analysts caution that the disruptions could ripple through the supply chain. Yet, some financial gurus, like Wedbush’s Daniel Ives, wish to calm nerves, viewing these tariffs as mere “scare tactics” and urging investors to seize buy opportunities amid the turmoil.

Despite these challenges, Nvidia revealed impressive Q3 results, reporting $35.08 billion in revenue—miles ahead of expectations. Growth in data centers, climbing 112% year-over-year, was a major driver. However, a conservative revenue projection for Q4 raised eyebrows, leaving investors wondering about the sustainability of its recent successes.

As of now, Nvidia holds a “Strong Buy” consensus rating with a potential 45% upside from current prices. While uncertainty looms, this tech titan continues to hold the trust of analysts and investors, hinting that the ride may get rocky yet rewarding for those who dare to hold on.

Takeaway: Stay alert and keep an eye on Nvidia—its stock could rebound sharply as market conditions evolve!

Nvidia’s Future: A Rollercoaster Ride of Opportunities and Challenges Ahead!

The Current Landscape of Nvidia

Nvidia has established itself as a leader in the graphics processing unit (GPU) market, primarily driven by its advancements in artificial intelligence (AI) and data center technology. Their recent quarterly performance showcased a significant leap, yet the challenges posed by tariffs and market shifts warrant a deeper exploration of Nvidia’s position in the tech sector.

Key Features and Innovations

Nvidia’s portfolio continues to expand, focusing on AI, gaming, and data center technologies. Notable innovations include:

1. Nvidia H100 Tensor Core GPU – Designed for AI training and inference, capable of unprecedented performance levels.

2. GeForce RTX 40 Series – Focusing on gaming, these GPUs integrate advanced ray tracing technology, providing gamers with stunning visuals.

3. NVIDIA Omniverse – A platform for collaborative 3D content creation, merging simulation and real-world physics.

Comparisons to Competitors

– AMD: While AMD has seen growth with its Radeon GPUs and data center products, Nvidia remains the leader in AI applications due to its extensive software ecosystem and dedicated hardware.

– Intel: Intel’s recent forays into the GPU market aim to disrupt the status quo; however, Nvidia’s specialized offerings for AI and deep learning retain a substantial competitive edge.

Market Predictions and Trends

Analysts forecast continued growth in the AI and cloud computing sectors, projecting that:

– The global AI market could reach $190.61 billion by 2025, with Nvidia expected to capture a significant market share.

– Data center revenue is anticipated to grow, driven by increased demand for AI computing capabilities.

Pros and Cons of Investing in Nvidia

Pros:

– Strong growth trajectory in AI and gaming sectors.

– Robust financial performance with $35.08 billion in Q3 revenue.

– Analysts express a bullish outlook with a “Strong Buy” rating.

Cons:

– Uncertain impact of tariffs and geopolitical tensions.

– Conservative revenue projections for the upcoming quarter may dampen enthusiasm.

– Potential disruptions in the supply chain due to Foxconn’s manufacturing shifts.

Essential Questions About Nvidia’s Performance

1. What are the long-term implications of tariffs on Nvidia?

While tariffs may not directly impact Nvidia’s core business, they create uncertainty that could affect supply chains and costs. Investors should consider the company’s adaptability amidst these challenges.

2. How sustainable is Nvidia’s growth in the current market?

Given Nvidia’s impressive Q3 results and continued demand for AI and gaming technologies, most analysts believe its growth is sustainable, albeit subject to market fluctuations.

3. What should investors watch for in the upcoming quarters?

Investors should focus on Nvidia’s ability to meet or exceed revenue forecasts, any shifts in tariff regulations, and how it navigates potential supply chain disruptions.

Conclusion

Nvidia’s journey is filled with potential rewards for investors willing to navigate the accompanying risks. As the tech landscape evolves, keeping an eye on Nvidia’s developments will be crucial for making informed investment decisions.

For those interested in additional insights and news, check out the main site: Nvidia.