The financial world has been captivated by Palantir Technologies, which has seen its stock soar an astonishing 319% in 2024. Much of this success is attributed to its pioneering AI software, highly sought after by both businesses and governments driven by a need to harness the power of generative AI for enhanced data analysis.

Despite this remarkable rise, there’s a caveat: Palantir’s current valuation poses a significant concern. Trading at 67 times sales and 372 times earnings, it positions the stock far from the category of value investments. Maintaining such a high valuation demands Palantir to persistently outshine Wall Street’s expectations. With analysts predicting a possible 48% dip from its current peak, the allure of this stock may soon wane for risk-averse investors.

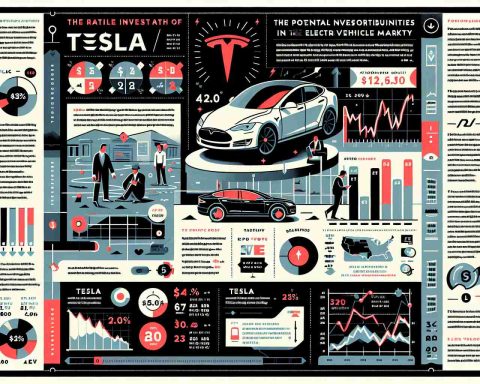

Enter C3.ai, a rising star in the enterprise AI software arena. While its stock returns haven’t matched Palantir’s explosive performance, investors could view this as an opportunity. C3.ai offers a more attractive valuation without compromising on growth potential. The latest fiscal quarter ended October saw a revenue surge of 29% year-over-year, with profits exceeding forecasts.

C3.ai’s success is largely due to solidifying relationships with major corporations and expanding its federal clientele. Its collaboration with entities such as ExxonMobil and the U.S. Department of Defense has propelled its portfolio, positioning the company for further growth.

Looking ahead, C3.ai forecasts an optimistic fiscal year, projecting a 25% revenue increase. Its attractive price-to-sales ratio of 15 versus Palantir’s lofty multiple underscores its potential as a compelling investment. For those who missed out on Palantir’s sky-high ascent, C3.ai offers a more accessible yet promising gateway into the AI sector.

Unexpected AI Contenders: Why C3.ai Could Be the Next Big Thing

In the dynamic world of artificial intelligence, companies like Palantir Technologies have captured the spotlight with extraordinary stock market returns. However, an overlooked player, C3.ai, is emerging as a strong contender in the AI industry, offering promising prospects for investors. Let’s explore the new trends, insights, and future potential that C3.ai holds in this competitive landscape.

Palantir’s Impressive Yet Risky High Valuation

Palantir Technologies has witnessed an unprecedented stock surge, primarily driven by its advanced generative AI software, which has become essential for businesses and government agencies aiming to leverage sophisticated data analytics. However, this meteoric rise comes with caution due to the company’s hefty valuation. Trading at 67 times sales and 372 times earnings, it stands as a precarious investment choice, particularly for those wary of market volatility. Analysts warn of a potential significant decrease in Palantir’s stock value, causing investors to consider alternatives.

C3.ai: An Emerging Opportunity in AI

While Palantir basks in the limelight, C3.ai presents itself as an appealing alternative for investors seeking substantial growth without the burden of inflated valuation. C3.ai reported an impressive 29% year-over-year revenue increase in its latest fiscal quarter, with profits surpassing expectations. The company attributes its success to robust partnerships with prominent players such as ExxonMobil and the U.S. Department of Defense, which helps expand its federal enterprise clientele.

C3.ai’s Future Prospects and Market Position

As C3.ai looks ahead, the company projects a promising fiscal year with a 25% rise in revenue. With a price-to-sales ratio of 15, it stands in stark contrast to Palantir’s elevated multiples, making it an attractive proposition for investors. The company is strategically positioned to solidify its footing in the AI sector, offering a sustainable growth trajectory that could appeal to both veteran investors and newcomers who missed Palantir’s initial surge.

Key Takeaways for Investors

For those hesitant about Palantir’s high-stakes stock, C3.ai presents a viable option that balances promising growth with more approachable valuation metrics. Its strategic collaborations and solid revenue growth forecast demonstrate a potential for long-term success in the disparate realms of enterprise AI.

To learn more about the evolving landscape of AI technology and investment strategies, explore the official pages of Palantir Technologies and C3.ai for in-depth insights and updates.