In the complex world of investments, the role of debt is often misunderstood. Hangzhou Honghua Digital Technology Stock Company LTD. (SHSE:688789), like many companies, utilizes debt to fuel growth. The key question for investors is whether this use of debt spells trouble or opportunity.

Understanding Debt’s Impact

The real risk of debt arises when a company struggles to repay it. Often, this can lead to lenders asserting control or forcing companies to dilute stocks at unfavorable prices. Yet, debt can also be a catalyst for growth when managed wisely.

Examining the Details

Hangzhou Honghua has increased its debt from CN¥44.9m to CN¥337.9m in the past year. However, the company holds a substantial cash position of CN¥1.23b, resulting in a net cash balance of CN¥896.4m. This indicates that Hangzhou Honghua is not over-leveraged and could comfortably manage its liabilities.

Financial Health and Prospects

The balance sheet reveals that Hangzhou Honghua’s liquid assets exceed its liabilities by CN¥1.04b, highlighting its robust liquidity. Furthermore, a 45% boost in EBIT over the past year suggests the company’s operational capability to handle its debt. Nevertheless, the past negative free cash flow raises some concerns about how quickly earnings are converted into cash.

Looking Forward

While the current balance sheet is reassuring, the company’s future earnings are crucial in supporting its financial health. Investors should also be mindful of potential risks, as the company’s ability to maintain positive cash flow will determine its long-term sustainability.

Understanding the balance between debt and growth is essential. For investors wary of risk, exploring companies with little or no debt might be an attractive path.

This Company Is Mastering Debt: Here’s What You Need to Know

In the realm of finance, debt is often a double-edged sword. As we navigate through different investment strategies, it’s insightful to explore how the strategic use of debt impacts communities and the broader economy. Let’s delve into some intriguing, lesser-known aspects of debt and its ripple effects, uncovering the good, the bad, and the controversial.

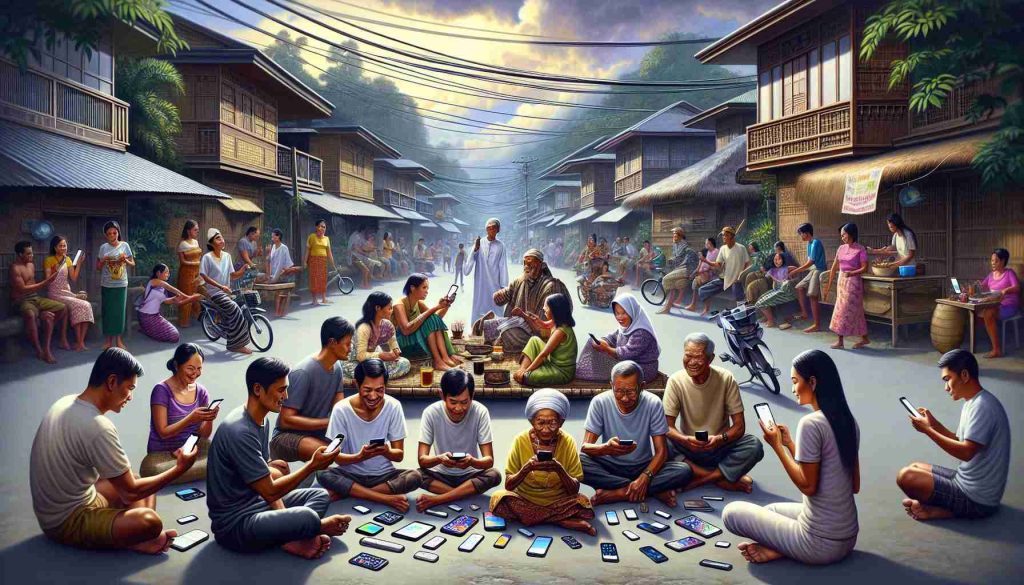

Hidden Gems: How Debt Drives Local Economies

The informed use of debt by corporations like Hangzhou Honghua Digital Technology Stock Company LTD. isn’t just about internal growth—it often has a profound external impact. By leveraging debt efficiently, companies can invest in local economies, creating jobs and stimulating innovation across industries. For instance, when companies increase their workforce or build new facilities, they contribute directly to the economic vibrancy of their communities.

Controversies and Debates: Is Debt a Sustainable Growth Tool?

While the use of debt can catalyze economic growth, it also sparks debates on its sustainability. Critics argue that excessive debt, even when manageable, can lead to economic instability, especially in developing countries. It raises questions about the long-term economic sovereignty when corporations amass significant liabilities.

Advantages and Disadvantages: Navigating the Debt Maze

There are clear advantages to utilizing debt. It can serve as a lever for exponential growth without immediately sacrificing equity. Moreover, during periods of low-interest rates, debt becomes a cost-effective way to finance expansion.

However, disadvantages abound as well. The crux of the issue is the risk of over-leverage, where debt eclipses profits, leading to potential financial distress or bankruptcy. This risk is especially pronounced during economic downturns or periods of high-interest rates, where debt servicing becomes burdensome.

Intriguing Questions: The Future of Debt and Investment

– How will global economic shifts affect corporate debt strategies? As economies fluctuate, companies might reassess their leverage strategies to remain competitive and secure.

– What role does technology play in managing corporate debt? With advancements in financial technology, companies can now better predict, manage, and optimize their debt portfolios for strategic growth.

– Can debt fuel sustainable development? With increasing emphasis on sustainable business practices, the role of debt in financing green projects and infrastructure is gaining traction.

For more insights into finance and investment strategies, explore Investopedia and Yahoo Finance.

By understanding these dynamics, investors can better assess the companies they back and the broader impacts these decisions have on societies and future economic landscapes. With both promise and peril interlacing the tapestry of corporate debt, it’s imperative to stay informed and discerning.