In a market where tech stocks are shattering records, there remain hidden gems that savvy investors should not overlook. Despite the S&P 500 and Nasdaq Composite flirting with historical heights, two major players in the AI hardware sector—Advanced Micro Devices (AMD) and Micron Technology—are quietly trading at significant discounts.

While Nvidia leads the AI hardware narrative, AMD and Micron have carved out critical roles in this burgeoning field. AMD is renowned for its cutting-edge processors, including the Ryzen series and the formidable Epyc and Instinct lines. These products are instrumental in powering AI supercomputers by processing massive amounts of data efficiently. However, AMD isn’t alone in this endeavor. Micron emerges as a vital player, thanks to its advanced memory chips that meet the demands of AI-driven devices, both in consumer tech and high-performance computing.

Interestingly, both companies showcase impressive growth fueled by AI technology. AMD reported an 18% increase in third-quarter sales, heavily bolstered by a 122% rise from its data center products. Micron’s impressive 93% revenue surge in its latest report underscores the robust demand for memory chips as AI continues to expand.

Despite these promising developments, both AMD and Micron are trading well below their peak prices, presenting investors with attractive opportunities. With anticipated profitability on the horizon, these stocks might just be the bargain investments that tech enthusiasts have been searching for. Now could be the opportune moment to invest in these unsung heroes of the AI revolution.

Unveiling the Unsung Technological Titans: How AMD and Micron Are Reshaping the AI Landscape

In the rapidly advancing world of technology, public attention often gravitates towards the giants dominating headlines. However, beneath the surface, companies like Advanced Micro Devices (AMD) and Micron Technology are quietly revolutionizing the AI hardware industry, offering unique opportunities and challenges shaping our lives and communities.

The Untapped Potential of AMD and Micron

Although Nvidia stands prominently in the AI spotlight, AMD and Micron’s contributions are by no means secondary. AMD’s relentless innovation with its processors, especially the Ryzen, Epyc, and Instinct series, plays a crucial role in AI computing. These processors enhance the capacity and efficiency of AI supercomputers, critical tools in medical research, climate modeling, and other areas striving for breakthroughs.

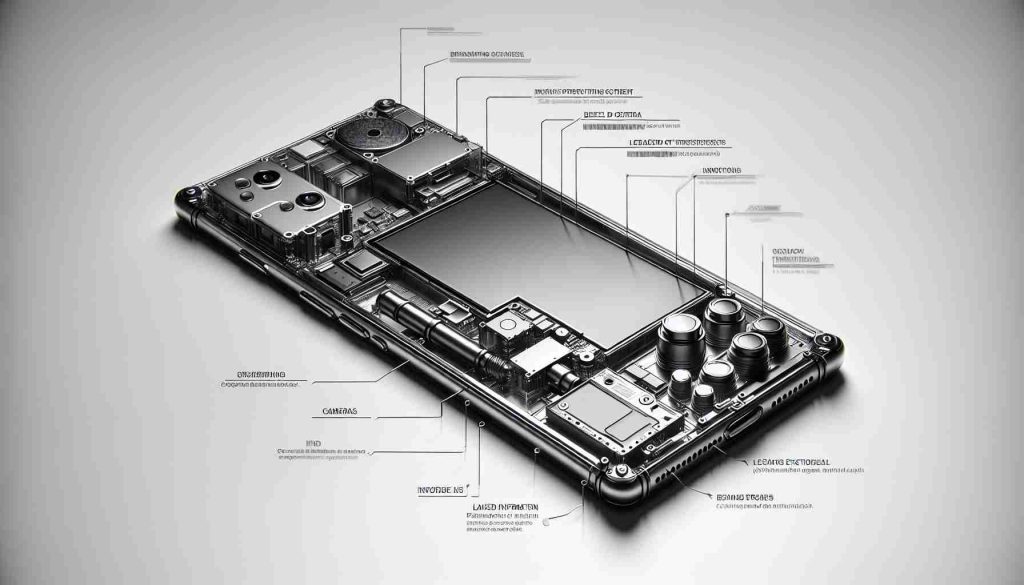

Micron, on the other hand, has strategically positioned itself with its memory technology prowess. The ever-growing demand for memory chips in AI-driven applications solidifies its essential role. From simple smartphones to intricate high-performance computing systems, Micron’s technology supports functionalities many take for granted but vastly improve our daily lives and global communication.

Impacts on Communities and Industries

The broader adoption of AI technologies, powered by AMD and Micron components, is transforming industries such as healthcare, automotive, and financial services. Improved AI capabilities lead to faster, more accurate diagnostics, self-driving car innovations, and efficient financial analysis. However, these technological advancements raise significant questions regarding job displacement and data privacy, highlighting the dual-edged sword of AI integration.

Communities stand to benefit from enhanced technological capabilities offered by AI developments, such as personalized learning tools and smarter civic infrastructure. Yet, the digital divide remains a pressing issue, potentially exacerbating inequality if access to these technologies is not democratized.

The Investment Dilemma: Risks and Rewards

For investors considering AMD and Micron, the allure lies in their current valuation and growth potential. Trading below peak prices might present a golden opportunity to invest in the future of AI hardware. Their recent sales surges suggest robust demand and promising profitability on the horizon, yet such investments are not devoid of risk.

Market volatility, driven by global semiconductor shortages and geopolitical tensions, underscores the unpredictability of investing in tech stocks. Furthermore, the competitive pressure from industry leaders like Nvidia adds another layer of complexity, demanding cautious analysis before investment.

Controversies Stirring the AI Sector

Beyond financial considerations, the ethical implications of AI development, such as biases in AI algorithms and the environmental impact of large data centers, present moral dilemmas. AMD and Micron must navigate these challenges, ensuring sustainable practices and fair technology deployment.

Questions to Consider:

– Will AI truly lead to more job creation, or will it primarily replace existing roles? Automation indeed threatens certain jobs but historically has also created new opportunities in tech-related fields.

– How can AMD and Micron ensure they remain competitive against larger firms like Nvidia? By maintaining innovation, strategic partnerships, and emphasizing sustainable technology.

For those eager to explore potential investment opportunities or delve deeper into the companies spotlighted in AI advancements, it’s important to stay informed about both global market dynamics and technological trends.

For more insights on AI industry leaders:

AMD

Micron Technology

In conclusion, while the glamor often centers on visible tech giants, firms like AMD and Micron are the quiet achievers whose innovations not only promise lucrative investments but also pose significant societal impacts and ethical questions worthy of exploration.