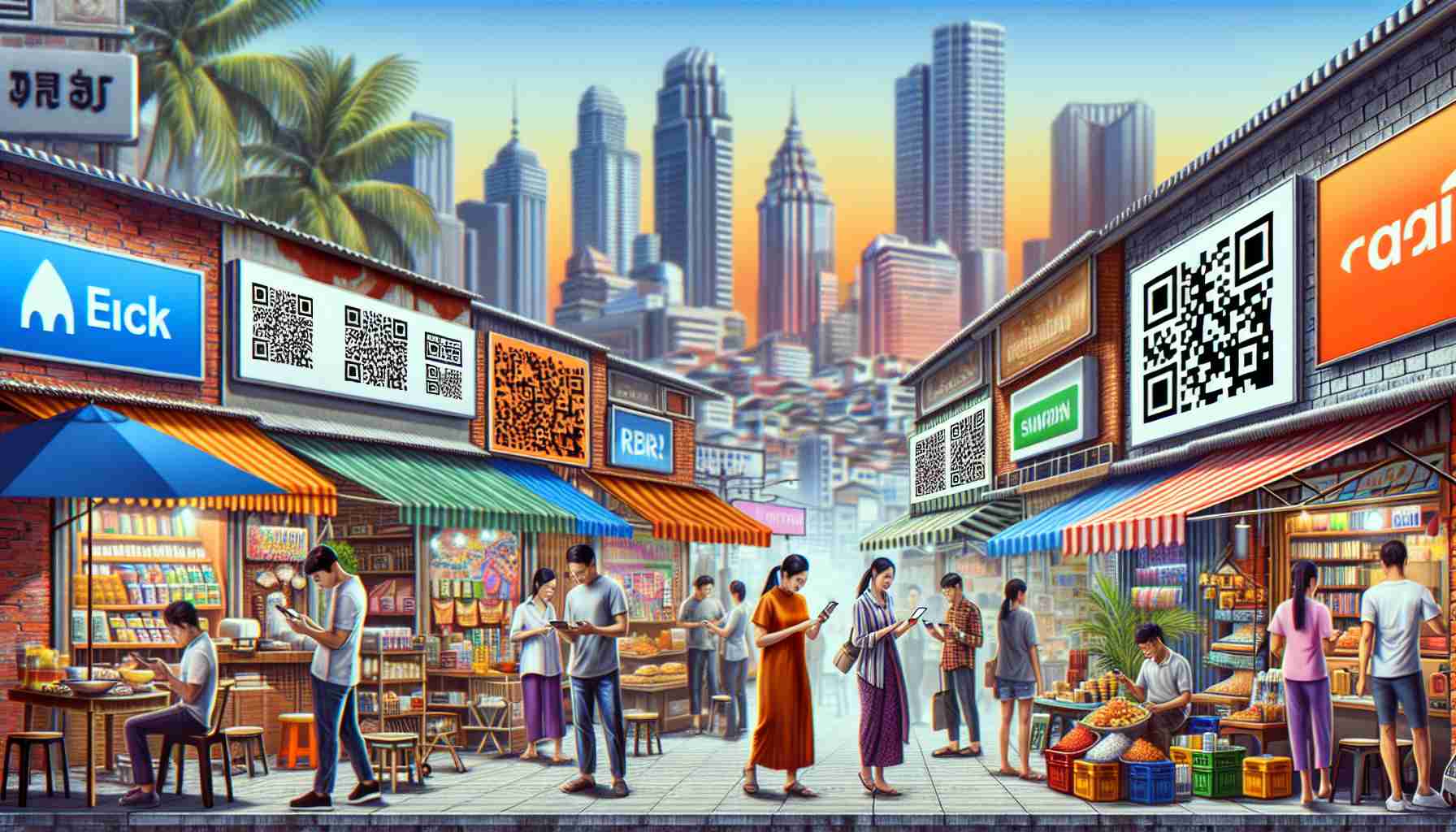

The rise of QR code payments is transforming the financial landscape across Southeast Asia, with countries like Malaysia and Cambodia at the forefront. This shift can be attributed to several factors, including low banking accessibility, a scarcity of ATMs in rural areas, and the proliferation of affordable smartphones. Furthermore, it is being bolstered by the expansion of cross-border travel services.

In Cambodia, the central bank reported a remarkable growth in QR transactions, with a staggering 29% increase this year, equating to approximately 601 million transactions. This surge can be traced back over three years, highlighting the growing reliance on this payment system. The recent introduction of the Bakong Tourists mobile payment system facilitates cashless transactions for tourists, promoting the use of the local riel currency. This system is part of a broader framework established by the Bakong digital payment initiative launched in 2020.

Meanwhile, in Malaysia, the DuitNow QR platform has rapidly become fundamental to the country’s digital payment ecosystem since its launch in 2019. In just the first half of this year, it processed 1.5 billion transactions amounting to 1.37 billion ringgit, reflecting a significant increase compared to the previous year.

Beyond national borders, Singapore’s PayNow system has also seen impressive growth, handling 437 million transactions amounting to 157 billion SGD. This interconnectivity is paving the way for seamless financial transactions throughout the region, enhancing cross-border economic activities and boosting tourism.

Tips and Interesting Facts About QR Code Payments in Southeast Asia

As the landscape of financial transactions evolves, QR code payments are becoming increasingly commonplace, particularly in Southeast Asia. This shift is not just a trend; it’s fundamentally changing how individuals and businesses conduct transactions. Here are some tips and interesting facts about QR code payments that could be valuable to you in various aspects of your life, work, and school.

1. Embracing Digital Transactions

As QR code payments gain traction, consider embracing digital transactions for everyday purchases. This can save you time and reduce the need for physical cash. Furthermore, the use of QR codes can enhance your budgeting strategies by allowing you to track your spending through payment apps.

2. Understanding Cross-Border Payment Systems

If you travel across Southeast Asia, familiarize yourself with local QR payment systems like Cambodia’s Bakong and Malaysia’s DuitNow. These systems are becoming widely accepted and can facilitate smoother transactions while traveling. Always check if your bank has affiliations with these platforms to minimize transaction fees.

3. Safety First

While QR code payments are generally safe, it’s essential to exercise caution. Always use trusted apps, avoid scanning QR codes from unknown sources, and ensure your device is equipped with up-to-date security software. Monitor your bank and payment app transactions regularly to protect against fraud.

4. Learning and Adapting in Educational Settings

In schools and universities, QR codes can streamline administrative tasks, such as fee payments and attendance tracking. Students and educators should consider integrating QR payment systems to make processes more efficient. Additionally, schools can use QR codes to promote events and activities, encouraging participation through convenient payment methods.

5. Businesses Can Benefit

For entrepreneurs and small business owners, adopting QR code payments can enhance customer experience. Displaying QR codes at checkout allows customers to make transactions quickly, thus reducing queues and improving service efficiency. You could also consider providing discounts or loyalty points for customers who opt for QR code payments, encouraging more people to use this method.

6. The Role of Affordable Technology

The widespread adoption of affordable smartphones is fueling the QR payment revolution. If you’re looking to join this trend, ensure your smartphone is compatible with the latest payment apps. Investing in a good smartphone can open doors to various digital payment methods, educational resources, and business opportunities.

7. Exploring Future Opportunities

With the ongoing advancements in payment technology, being knowledgeable about QR codes can future-proof your career or business. As the economy evolves towards more digital interaction, being proficient in new payment methods will be an asset. Learning more about blockchain technology and how it intersects with QR payments can provide you with additional insights into future trends.

By incorporating these tips and understanding the interesting aspects of QR code payments, you can navigate this emerging trend more effectively. The shift towards cashless transactions in Southeast Asia not only simplifies everyday life but also opens up new avenues for growth and innovation.

You can learn more about financial technologies and digital payments at GlobalData.