Recent analysis highlights a significant shift in the smartphone market within Southeast Asia, as local preferences evolve and competition intensifies. Chinese smartphone manufacturers are gaining ground by offering quality devices at competitive prices, with several models available for around $200.

A 25-year-old gamer from Cavite, Philippines, recently purchased an Infinix smartphone for approximately $178. He was drawn to the brand after a friend recommended it for its gaming capabilities, noting the device’s reliable performance. However, he expressed some dissatisfaction with its camera quality, a common trade-off for gaming-centric phones.

Mobile retail outlets in Manila showcase affordable options from brands like Tecno, which cater primarily to younger consumers, particularly those enthusiastic about gaming. These devices have gained immense popularity, significantly impacting Samsung’s market share, which has decreased to around 15%, compared to Transsion’s leading position of 31% in the Philippines.

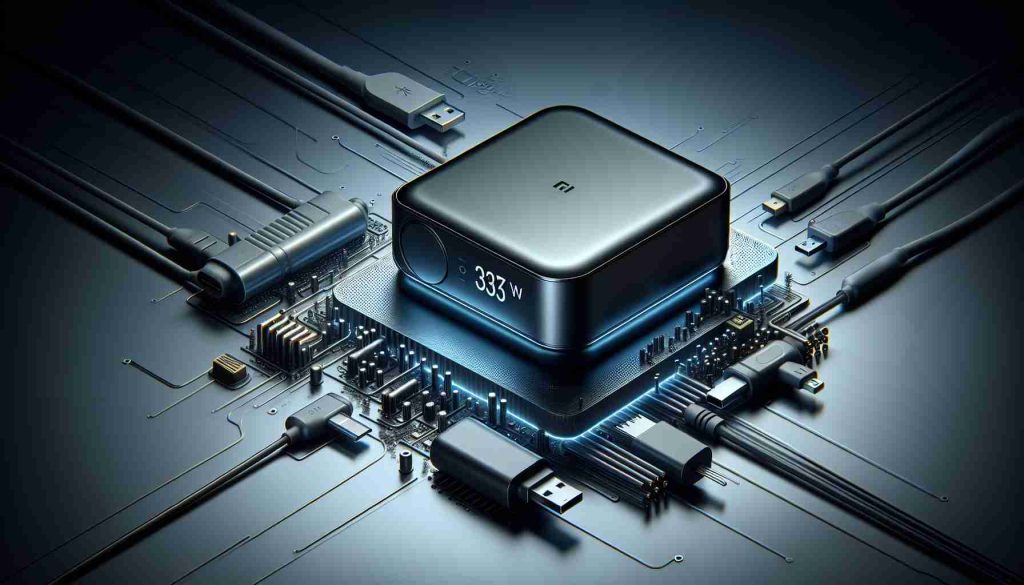

Meanwhile, companies like Oppo and Xiaomi are also expanding their low-cost smartphone offerings in the region. Samsung is shifting its marketing strategy to emphasize premium features, including AI capabilities, in an effort to retain its market presence.

Apple, countering this competitive landscape, is planning its re-entry into Southeast Asia. With a focus on expanding its distribution networks and launching the upcoming iPhone 16, the tech giant aims to capture a larger share of the growing high-end smartphone segment, fueled by increasing consumer spending.

Smartphone Market Dynamics in Southeast Asia: A Shift in Competitive Landscape

The smartphone market in Southeast Asia is experiencing profound transformations as consumer preferences evolve and competition intensifies among local and international brands. This article investigates the shifting dynamics, emerging trends, and key players that are reshaping the industry landscape.

What factors are driving the change in the Southeast Asian smartphone market?

Several factors are influencing these changes, including the rapid increase in internet penetration, which has risen to over 70% across the region. The growing number of local tech startups also contributes to innovation and competition. Furthermore, a surge in the adoption of e-commerce and social media has resulted in a more informed consumer base, demanding better features at lower price points.

What are the key challenges in this shifting landscape?

Key challenges include intense price competition, which pressures profit margins, and the need for brands to quickly adapt to changing consumer preferences. Additionally, addressing fragmented markets and varying regional regulations poses challenges for manufacturers. The presence of counterfeit products undermines brand integrity, and companies must innovate continuously to maintain relevance.

What advantages and disadvantages do consumers face in this evolving market?

Consumers benefit from a broader selection of budget-friendly devices that offer advanced features. The competition among brands ensures lower prices and frequent sales promotions, enhancing affordability and access. However, the overwhelming choice can lead to decision fatigue, and the quality of some lower-priced smartphones can be inconsistent, potentially resulting in subpar user experiences.

Who are the major players in this evolving market landscape?

Besides established brands like Samsung and Apple, Chinese manufacturers such as Xiaomi, Oppo, and Transsion are making significant strides. Local brands like Infinix and Tecno cater specifically to the gaming demographic and budget-conscious consumers, thereby posing a challenge to more prominent players. For instance, Transsion has successfully aligned its offerings with the region’s unique preferences and has captured leading market shares.

What is the future potential for the Southeast Asian smartphone market?

The future of the smartphone market in Southeast Asia looks promising, with projections indicating a compound annual growth rate (CAGR) of 8% in the next five years. As consumers continue to demand technologically advanced features such as 5G connectivity, artificial intelligence, and enhanced camera technology, brands that can effectively integrate these innovations into their offerings are likely to thrive.

In conclusion, the competitive landscape of the Southeast Asian smartphone market is rapidly evolving. To remain at the forefront, manufacturers must navigate challenges while capitalizing on the opportunities presented by a diverse and dynamic consumer base.

For more insights on the smartphone market, visit Counterpoint Research and Strategy Analytics.