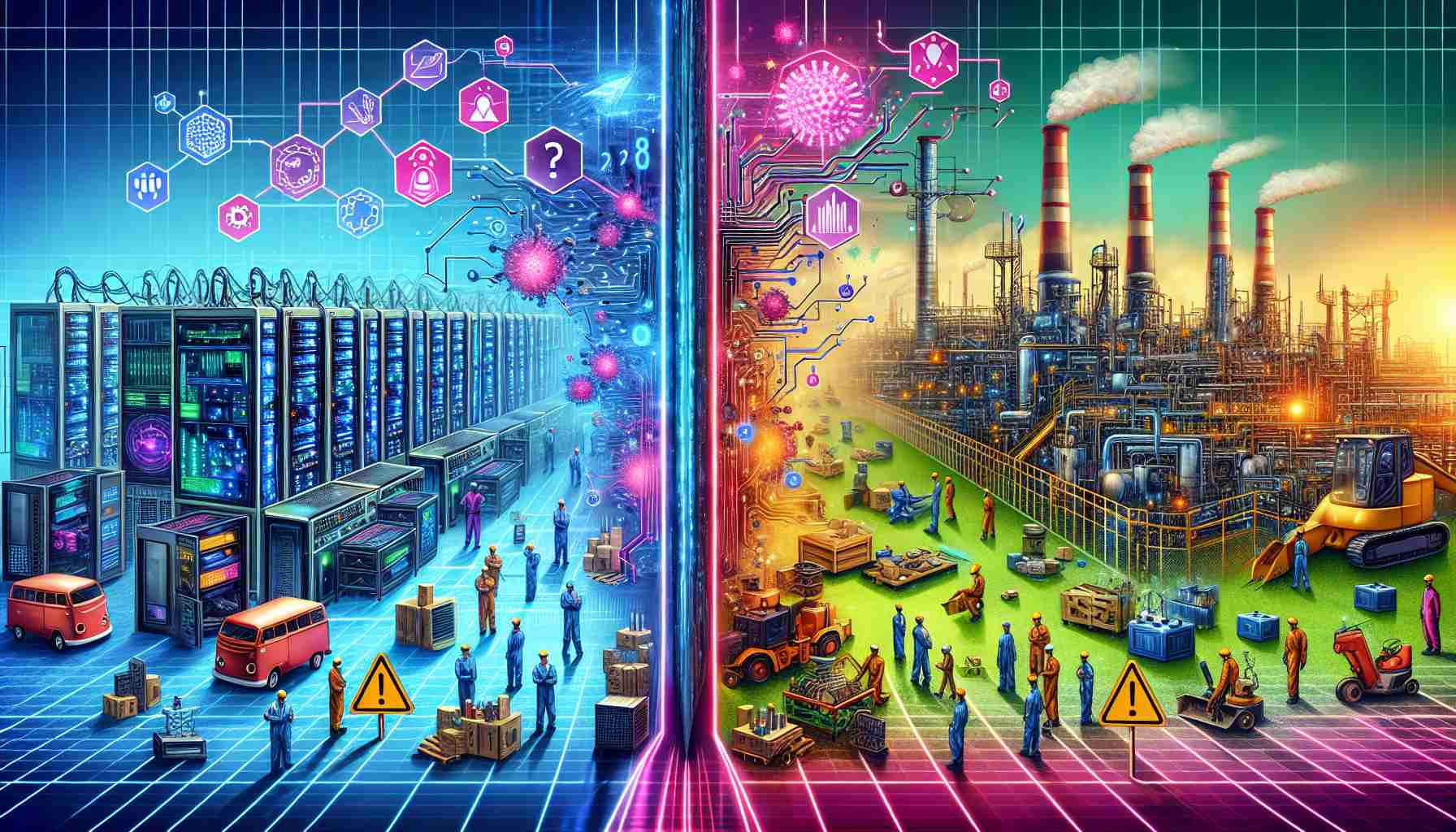

Excitement is buzzing in anticipation of the upcoming budget presentation by Finance Minister Nirmala Sitharaman, which is scheduled for July 23. As stakeholders eagerly await announcements, speculations are rife about potential implications for the tech and manufacturing sectors.

One of the key points of interest is the potential impact on smartphone prices, with hopes that the government may consider reducing taxes on mobile phones. Such a move could lead to a decrease in smartphone prices, benefitting a wide range of consumers, especially the middle class.

Additionally, the revival of the Production Linked Incentive (PLI) scheme is expected to be a cornerstone of the new budget. The scheme, aimed at promoting domestic manufacturing and boosting exports, incentivizes companies to increase production within India. This is projected to not only foster local manufacturing but also create employment opportunities and attract new investments.

With the automobile industry also on the radar, industry experts from the Society of Indian Automobile Manufacturers (SIAM) are hopeful for significant announcements that will bolster growth in the sector. As part of the broader strategy to stimulate economic growth, the government is likely to unveil measures to support various industries, including electronics and textiles.

As the budget presentation draws near, the business community is poised for potential game-changing policies that could reshape the landscape of the tech and manufacturing sectors in India.

Anticipating the Impact of Budget 2024: Unveiling New Insights

As the much-anticipated budget presentation by Finance Minister Nirmala Sitharaman approaches on July 23, stakeholders and experts are abuzz with speculation about the potential ramifications for the tech and manufacturing sectors. While the previous article touched on key aspects, there are additional crucial points to consider regarding Budget 2024.

Key Questions:

1. How might the budget address the growing demand for renewable energy technologies in the tech and manufacturing sectors?

2. Will there be specific provisions to encourage research and development in emerging technologies such as artificial intelligence and quantum computing?

Answers and Insights:

– The budget is expected to introduce incentives for companies investing in renewable energy solutions to promote sustainability and reduce carbon footprint in manufacturing processes.

– Provisions for research grants and tax breaks may be announced to stimulate innovation in cutting-edge technologies, positioning India as a global hub for tech research and development.

Challenges and Controversies:

– Balancing the need for revenue generation through taxes with the imperative to incentivize growth in the tech and manufacturing sectors poses a delicate challenge for policymakers.

– Controversies may arise regarding the allocation of funds between traditional manufacturing industries and newer technology-driven sectors, raising questions about equitable distribution of resources.

Advantages and Disadvantages:

– Advantages: The budget may usher in a new era of innovation and competitiveness, attracting foreign investment and driving job creation in high-tech manufacturing segments.

– Disadvantages: Rapid changes in tax policies or incentives could lead to uncertainty and volatility in the business environment, affecting long-term planning for companies in these sectors.

As the budget unveiling draws closer, it is evident that the implications for the tech and manufacturing sectors are multifaceted and could have far-reaching consequences on India’s economic landscape.

For further insights on budget-related news and updates, visit Ministry of Finance and stay informed about the latest developments shaping the economic future of the country.