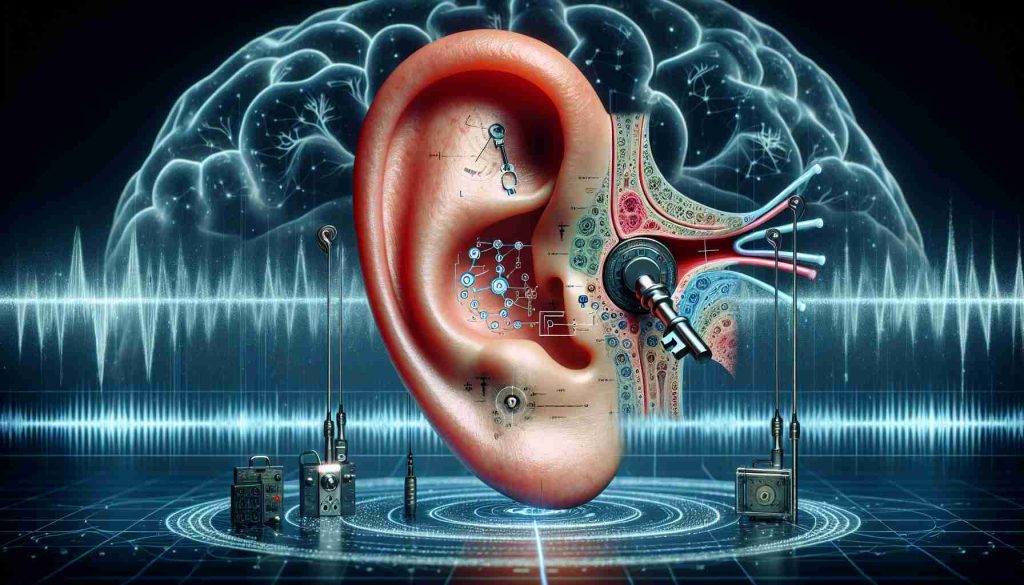

A young woman in her twenties recently shared her distressing experience of being bombarded with phone calls by debt collectors after missing a repayment deadline to an online lending platform. The incident sheds light on the concerning trend of aggressive debt collection practices targeting vulnerable borrowers.

In response to the prevalence of such practices, regulatory measures have been introduced over the years, aiming to curtail abusive debt collection tactics in the online lending sector. However, despite these efforts, the issue persists, highlighting the need for more effective solutions.

One of the underlying problems contributing to the cycle of debt for many young borrowers is the lack of financial literacy and awareness of the risks associated with online lending. Unscrupulous practices by some online lending platforms, such as concealing exorbitant interest rates and excessive collection of personal data, further exacerbate the vulnerabilities of borrowers.

To address these challenges, it is crucial to establish a healthy lending environment by enforcing stricter regulations on online lending platforms and enhancing transparency in financial transactions. Additionally, providing young consumers with access to legitimate and secure lending options can help steer them away from predatory practices.

By nurturing a culture of responsible borrowing and fostering an ecosystem of trust and integrity in the lending industry, stakeholders can empower young consumers to make informed financial decisions and protect their rights. Ultimately, creating a conducive environment for ethical lending practices is key to safeguarding the interests of borrowers and promoting sustainable financial well-being.

The Challenges Faced by Young Consumers in the Online Lending Industry: Unveiling Key Issues and Solutions

Amid the growing popularity of online lending platforms, young consumers are increasingly encountering a myriad of challenges that affect their financial well-being and future prospects. While some factors have been highlighted in previous discussions, there are additional critical aspects that deserve attention to provide a comprehensive understanding of the landscape. Here are some essential questions and answers, as well as key challenges and controversies associated with the topic:

What are the most important questions young consumers should ask before engaging with an online lending platform?

Young consumers should inquire about the transparency of interest rates, repayment terms, and total loan costs. They should also seek clarity on the platform’s data privacy policies and the consequences of defaulting on payments. Understanding these aspects can help borrowers make informed decisions and avoid falling into debt traps.

What are the advantages and disadvantages of online lending for young consumers?

Advantages include easy accessibility, quick approval processes, and convenient application methods. However, disadvantages encompass the risk of predatory lending practices, hidden fees, and aggressive debt collection techniques that can lead to financial distress and long-term consequences.

What are the key challenges or controversies impacting young consumers in the online lending industry?

One prevalent challenge is the lack of financial literacy among young borrowers, which leaves them vulnerable to exploitative practices. Moreover, the regulatory gaps in the online lending sector enable unscrupulous platforms to engage in unfair tactics, posing a threat to consumers’ financial stability.

To delve deeper into these issues and explore potential solutions, it is crucial to engage in constructive dialogues that prioritize consumer protection and financial education. By advocating for stricter regulations, enhancing transparency measures, and promoting ethical lending practices, stakeholders can create a safer and more sustainable environment for young consumers in the online lending industry.

For further insights and resources on responsible borrowing and financial literacy, visit the Consumer Financial Protection Bureau website. Empowering young consumers with knowledge and resources is essential for navigating the complexities of the online lending landscape and securing their financial well-being.