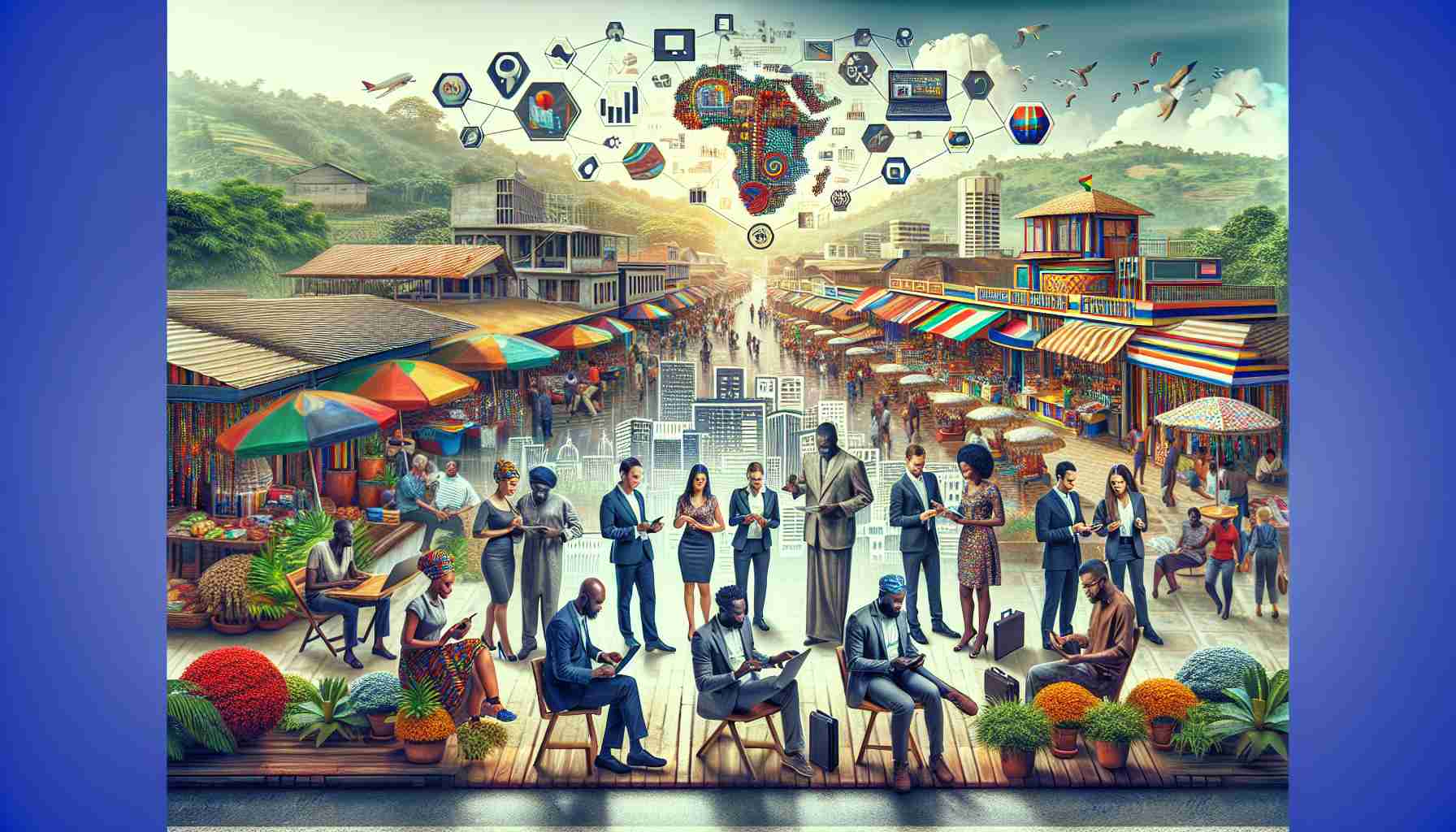

Anita Akpeere’s catering enterprise thrives in the heart of Ghana thanks to her internet-enabled phone that continually receives orders for her popular kenkey, a local delicacy. Highlighting her experience, she emphasized that her success is tethered to this technology as order notifications are relentless even while she’s at rest.

In an environment where public infrastructure ranks among some of the world’s less developed, mobile phones are breaking barriers, according to insights from Tufts University’s Professor Jenny Aker, who specializes in this field. These devices are instrumental for many in sub-Saharan Africa, facilitating services such as mobile banking—a lifeline for those without access to traditional financial institutions.

Despite the promise of mobile internet, access remains limited in sub-Saharan Africa with only a quarter of adults connected, as reported by Claire Sibthorpe, who champions digital inclusion at GSMA. The cost of smartphones is prohibitive, with the cheapest models demanding nearly an entire month’s salary for the poorest segment of the population. Yet, the desire to leverage mobile technology is strong and innovative solutions are emerging to overcome these economic challenges.

In the small village of Atabu, Cyril Fianyo, a local vegetable farmer, harnesses the full potential of his smartphone to expand his agricultural knowledge. Having invested in a smartphone through an installment plan, Fianyo delves into applications like Cocoa Link, which educates him on planting techniques and climate change impacts, thus empowering him to make better-informed decisions and potentially boost crop yields.

Rita Quansah from Uniti Networks spearheads digital literacy workshops for entrepreneurs, including market women. With their app Oze, users can manage finances in their native Ewe, transcending language barriers. This approach aligns with the trend GSMA has observed where mobile internet significantly contributes to the region’s GDP by filling infrastructural voids, exemplified by mobile money systems.

In the contrasting hustle of Accra, Akpeere’s anecdotes assert that mobile technology’s influence spans the socio-economic spectrum within Ghana, cementing its role as an indispensable tool for commerce across the nation.

Adding relevant information to the topic of mobile connectivity and its impact on business growth in Ghana:

– The Government of Ghana has taken initiatives to enhance mobile connectivity through the implementation of policy frameworks such as the “Mobile Telecommunication Policy” which aims to improve accessibility and affordability of telecommunication services.

– The use of mobile money services like MTN Mobile Money, Vodafone Cash, and AirtelTigo Money has transformed financial transactions, making it possible for people to send and receive money across the country without needing a traditional bank account.

– Mobile connectivity has also led to increased transparency in commerce through e-commerce platforms that allow consumers to shop for goods and services online, increasing competition and consumer choice.

– Access to market and weather information through mobile services enables farmers to make more informed decisions about planting and harvesting, thus improving agricultural productivity.

The most important questions related to the topic could include:

1. How does mobile connectivity contribute to economic growth in Ghana?

2. What are the challenges facing the expansion of mobile internet access in Ghana?

3. How are local entrepreneurs leveraging mobile technology to grow their businesses?

Answers:

1. Mobile connectivity contributes to economic growth in Ghana by enabling access to banking services, providing market information, improving communication for business transactions, and creating opportunities for digital literacy and online commerce.

2. The challenges facing the expansion of mobile internet access in Ghana include affordability of smartphones and data plans, coverage in remote areas, and digital literacy rates.

3. Local entrepreneurs are leveraging mobile technology to grow their businesses by using social media for marketing, mobile apps for business management, and mobile money services for financial transactions.

Key challenges or controversies related to mobile connectivity in Ghana often revolve around the following:

– The digital divide, where there is unequal access to mobile technology between urban and rural areas.

– Concerns regarding privacy and security of mobile financial transactions.

– The need for comprehensive regulatory frameworks to manage the growth of mobile services and safeguard consumer rights.

Advantages of mobile connectivity include:

– Improved access to banking and financial services.

– Enhanced communication for entrepreneurs and customers.

– Access to educational and informational resources.

Disadvantages may include:

– Affordability of mobile technology for lower-income individuals.

– Potential for fraud and other security issues in mobile banking and transactions.

– Dependency on mobile networks, which may pose risks in times of network failure or technical issues.

To learn more about mobile connectivity’s impact, the following links to relevant organizations might be helpful:

– GSMA for their insights on digital inclusion.

– International Telecommunication Union (ITU) for global telecommunication data and policy information.

Please note that links should always be checked for validity since changes in website structure can occur.

The source of the article is from the blog yanoticias.es