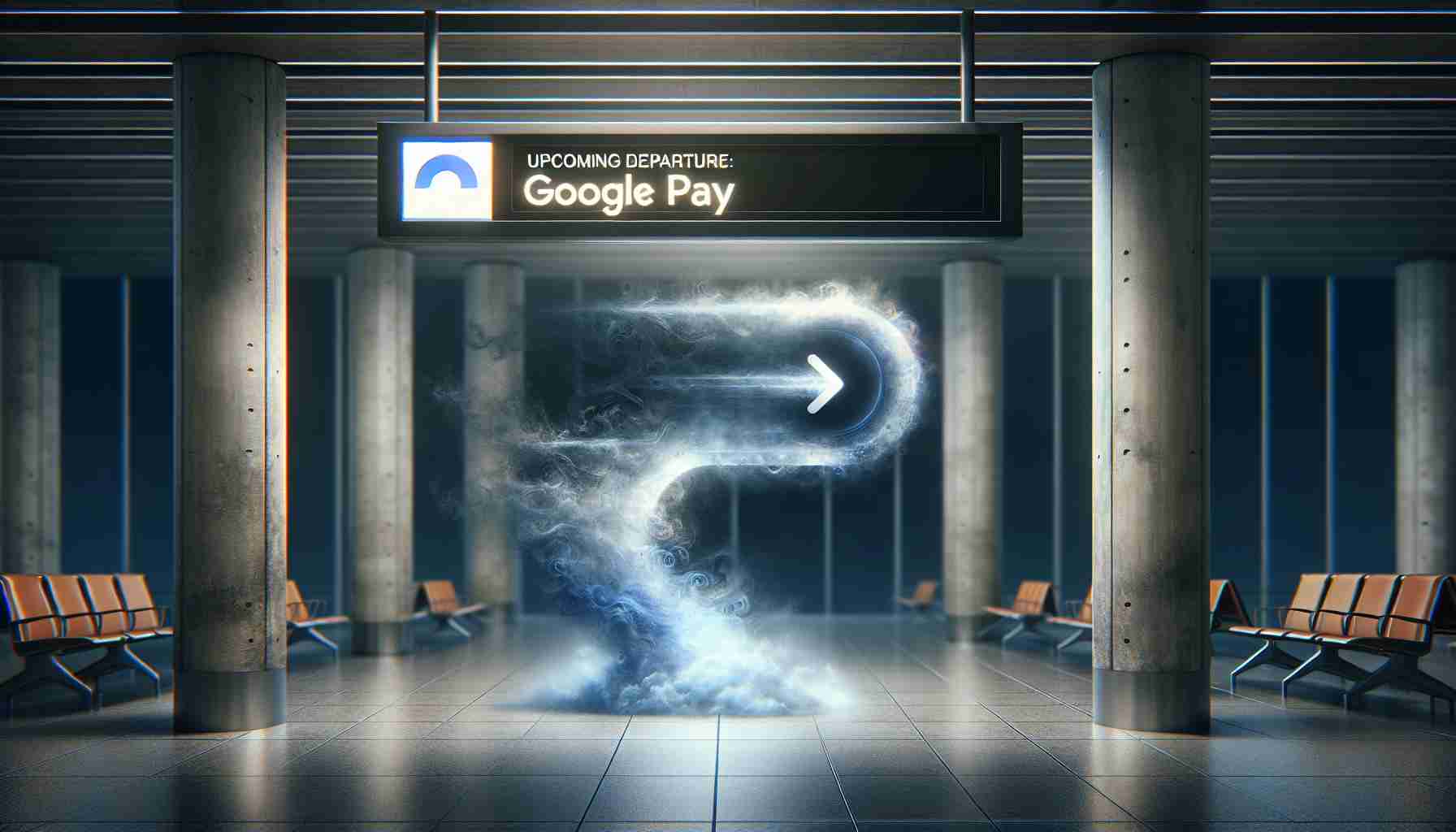

Google Wallet Takes Over Mobile Payment Services

On the digital payment front, it’s an end of an era; Google Pay will cease its send, request, and receive money features within the US starting June 4. When it comes to flexible online checkouts and straightforward money transfers, millions across a wide span of over 180 nations have relied on Google Pay since its inception in 2018.

Farewell to Google Pay, Hello to Google Wallet

Alphabet Inc., in a strategic move, is transitioning users from the standalone Google Pay application to the more versatile Google Wallet. This new platform is already being adopted at a higher frequency – a rate that is quintuple that of Google Pay’s current usage. Google Pay enthusiasts must address their account balances before the stipulated deadline or resort to the website version post-cutoff.

Google Wallet’s Comprehensive Digital Features

More than just a payment medium, Google Wallet is poised to store a range of essential and convenient digital items. From travel necessities to retail perks, even extending to secure vehicle access, Google Wallet aims to centralize and simplify life’s everyday transactions.

Global Shift to Contactless Transactions amidst Pandemic

The pandemic spearheaded a surge in non-contact payment adoption, not only for sanitary concerns but also due to promotional efforts from official bodies. This has restructured consumer expectations, fostering a growing preference for innovative, efficient financial tools. Google Wallet addresses this shift, supporting a multitude of tap-and-go functions, including integration with wearable technology that’s changing how we interact with numerous services.

Geographical Nuances in Google’s Strategy

Despite its pullback in the US, Google Pay remains integral in selected markets such as Singapore and India, thanks to new product ventures like the SoundPod. This regional specificity underlines Google’s tailored approach to diverse market needs.

The Universality of Google Wallet

In a landscape dominated by platform-specific wallets such as those offered by Apple and Samsung, Google Wallet stands out with its cross-platform operability. Although not all features of Google Pay may transition to Wallet, Google is committed to refining this experience, with a complete integration by mid-2024.

This comprehensive move by Google emphasizes its commitment to staying at the forefront of digital payments and ensuring ease of access for its global user base.

Key Questions and Answers:

– Why is Google replacing Google Pay with Google Wallet?

Google is consolidating its digital wallet and payment services into a single platform – Google Wallet, which is designed to offer more features and a more comprehensive digital wallet experience than Google Pay.

– How will Google Pay users be affected by the transition to Google Wallet?

Users will need to transfer their account balances and start using Google Wallet for future transactions. Google Pay features within the US – specifically the send, request, and receive money features – will be discontinued, and users will have to migrate to Google Wallet or use the web version.

– What can Google Wallet store besides payment information?

Google Wallet is expected to store digital items like boarding passes, event tickets, loyalty cards, and possibly vehicle keys in addition to payment cards.

– What challenges might users face in transitioning from Google Pay to Google Wallet?

Users might encounter challenges related to transferring their accounts, learning the new interface, and adapting to any changes in the services provided.

Advantages and Disadvantages:

Advantages:

– Google Wallet may offer a more holistic digital wallet experience by integrating additional functionalities.

– Cross-platform operability enhances accessibility for users across different devices.

– Contactless transactions provide convenience and enhance security.

Disadvantages:

– Transition period may create confusion or inconvenience for current Google Pay users.

– The discontinuation of familiar features may deter some users from switching to Google Wallet.

– Not all features available in Google Pay might be available immediately in Google Wallet during the transition.

Related Challenges and Controversies:

– Ensuring user data is securely transitioned from Google Pay to Google Wallet.

– Harmonizing the digital payment experience globally while catering to local market variations.

Suggested Related Link:

For more information on Google’s digital payments and wallet services, you can visit Google.