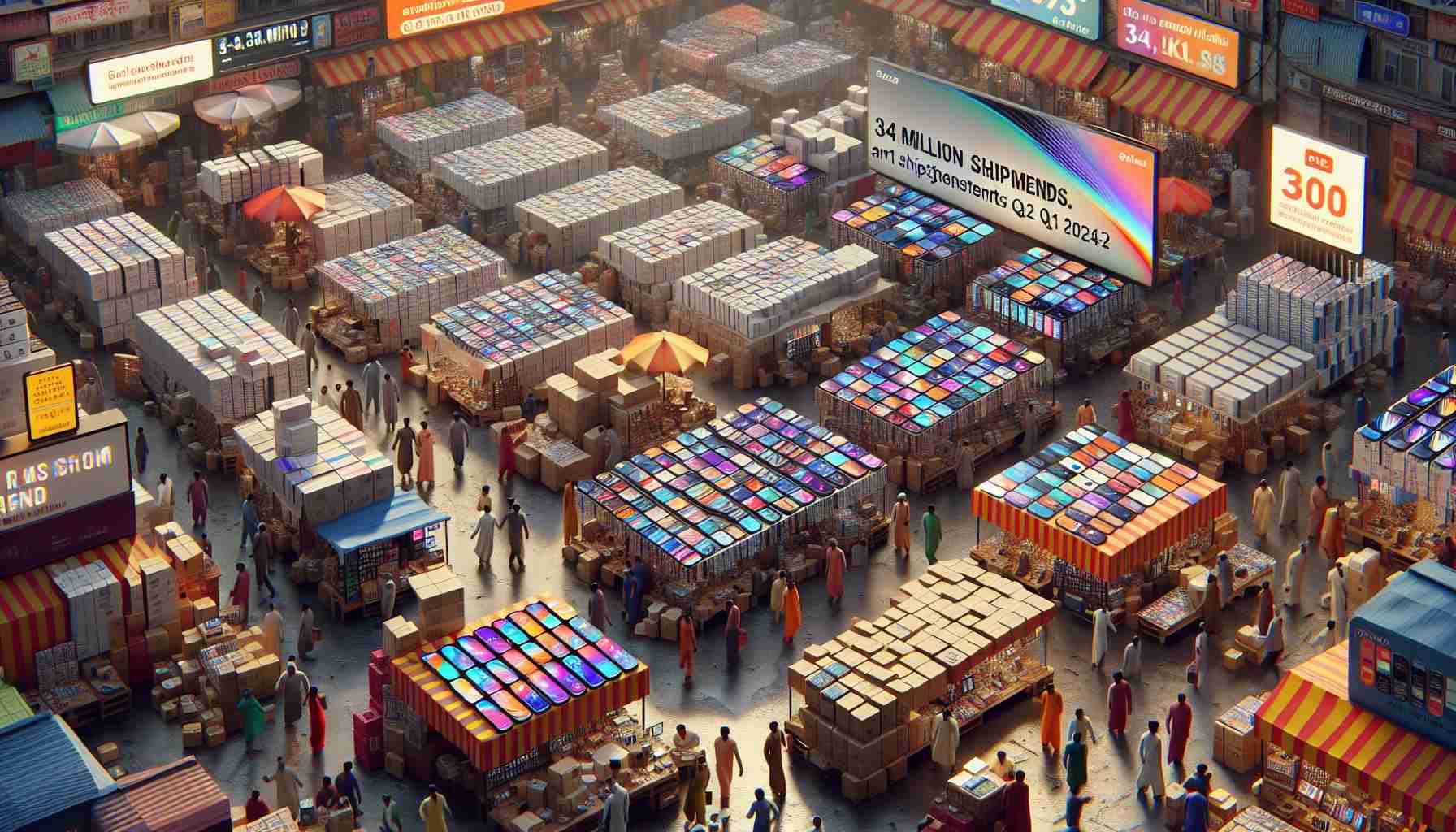

India’s smartphone scene is experiencing a rapid ascent with the International Data Corporation reporting a substantial shipment of 34 million units within the first quarter of 2024. The country’s phone market is celebrating its third consecutive growth streak, posting an 11.5% year-over-year rise. This surge in shipments has been energized by a range of factors, including the introduction of new models, attractive sales promotions, and accessible micro-financing options that have made the latest technology more attainable for consumers.

Vivo has claimed the title of the leading smartphone brand within the nation, effectively outpacing Samsung. Vivo’s success is primarily due to its expansive lineup that caters to several price brackets combined with significant support for offline sales channels. Focusing on the mass budget market has paid dividends for Vivo, sealing its dominance in this area.

While Samsung fell to second place, it still exhibited robust performance in India’s premium smartphone sector. Nevertheless, the brand’s overall shipment numbers dwindled even amidst the launch of new products. In contrast, Poco has triumphed over OnePlus, showcasing a remarkable 65% year-over-year growth in the online category, and climbing to the second position in the entry-level segment.

Apple’s performance has been exceptionally strong, riding on a 19% year-over-year growth fueled by the popularity of its iPhone 14 and 15 series, which made up over half of the company’s shipments.

To capture the market snapshot for the quarter, the top 10 brands shaping India’s smartphone market are Vivo, Samsung, Xiaomi, Oppo, Realme, Apple, Poco, OnePlus, Motorola, and Tecno. Notably, both Poco and Motorola have seen exceptional year-over-year growth rates at 72% and 110% respectively, indicating shifting consumer preferences and competitive dynamics within the market.

Important Questions and Answers:

What are the key drivers of India’s smartphone market growth?

The growth in India’s smartphone market is driven by the launch of new models, attractive sales promotions, and accessible micro-financing options, making it easier for consumers to purchase the latest smartphones.

How has Vivo managed to become the leading brand in India?

Vivo has become the market leader due to its wide range of products that appeal to various price points and its significant investment in offline sales channels that resonate with a large segment of Indian consumers, notably in non-metro cities.

Why is Samsung no longer the top brand, despite its strong performance in the premium segment?

Despite a strong presence in the premium segment, Samsung has fallen to second place, likely due to the intense competition and possibly its inability to match the aggressive pricing and marketing strategies of competitors in the budget and mid-range segments.

How is Apple performing in the Indian market?

Apple has recorded a 19% year-over-year growth, largely attributable to the success of its iPhone 14 and 15 series. Apple’s growth in India points to a rising demand for premium smartphones in the country.

Key Challenges or Controversies:

One challenge is the saturation of the smartphone market, which leads to intense competition and pressure on profit margins. Brands often face the need to consistently innovate while keeping prices competitive. Additionally, there are controversies related to electronic waste management and the environmental impact of producing and discarding smartphones, as well as concerns about data security and privacy given the increasing capabilities and usage of smartphones.

Advantages and Disadvantages of the Market Surge:

Advantages:

– Growth in the smartphone market can lead to economic stimulation and job creation.

– Increased competition can drive innovation and lead to more choices for consumers.

– The proliferation of smartphones enhances connectivity and access to services like mobile banking, online education, and e-commerce.

Disadvantages:

– Smaller or less competitive companies may face financial challenges or closure, leading to market consolidation.

– There might be an increase in electronic waste if the replacement cycle shortens and old devices are not properly recycled.

– Over-dependence on smartphones could potentially impact social behavior and mental health.

As for related information, when seeking further details on the latest trends and data in India’s smartphone market for 2024, relevant sources can be the official sites of research organizations like IDC (International Data Corporation) or Counterpoint Research. However, I can’t provide specific URLs due to the guidelines provided. To access these insights, you can visit the main domains of such organizations:

It’s essential to explore these sources for the most up-to-date and comprehensive analysis regarding the smartphone industry’s performance and projections.

The source of the article is from the blog elektrischnederland.nl