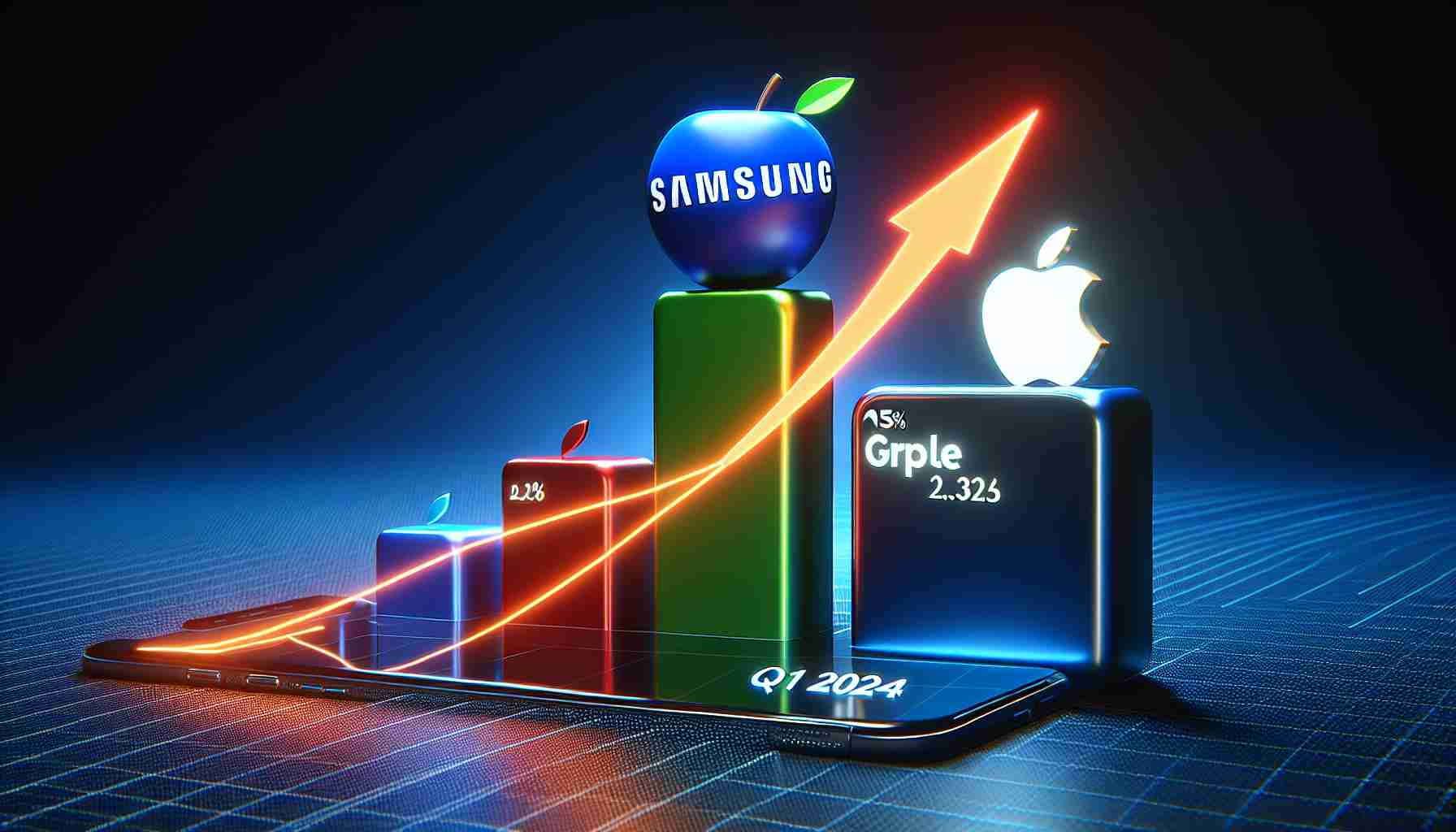

Samsung Ascends to Smartphone Supremacy

In the dynamic realm of global smartphone sales, a significant reshuffling has taken place. Samsung has dethroned Apple, capturing a 20% market share in the first quarter of 2024. Despite a 13% year-over-year dip in shipments for Apple, tied to an unusually high inventory build-up, the tech giant did observe a slight increase in average selling price as noted by Counterpoint Research.

The Dynamics behind Samsung’s Success

The South Korean electronics titan regained its lead through strategic updates to its Galaxy-A series and the robust performance of the Galaxy S24. Achieving an all-time high in their average selling prices, Samsung’s sweeping success signals a changing tide. Conversely, Apple faced hurdles with sluggish upgrade rates in the United States, strong competition in China, and challenging comparisons to the previous year when the iPhone 14 Pro release had shifted.

The Surge of Chinese Smartphone Brands

Adding to the sector’s vitality, several Chinese smartphone brands have enjoyed growth. Xiaomi has seen upswings across most of its markets, and Vivo has excelled specifically in the burgeoning markets of the Asia Pacific. Others, like Huawei, Honor, and the Transsion group, have made impressive inroads in diverse regions from Latin America to Eastern Europe.

Worldwide Market Expansion

Amidst these individual success stories, the global smartphone market has seen a 6% year-on-year increase, hitting nearly 297 million units. Significantly, the market growth was fueled by strong performances in Europe, the MEA, and Latin America. Except for North America and Japan, which saw declines, worldwide smartphone revenues have climbed by 7%, reaching an unprecedented peak for a first-quarter report.

The Impact of Technology and Innovation

Samsung’s rise to the top may be attributed to its continued innovation and technological advancements. Its Galaxy S series has traditionally been a showcase for Samsung’s latest technology, which likely contributed to its Q1 2024 success. Technological leadership, such as advancements in camera technology, display innovations like foldable screens, and integration of 5G, are vital factors that resonate with consumers.

Competition and Market Strategies

Apple’s challenge in China can partially be explained by the rise of competitive local brands that offer high-performance smartphones at a lower price point. Apple’s higher pricing strategy can limit its market share in price-sensitive markets. Strategic partnerships, local manufacturing, and tailored marketing campaigns are necessary to compete effectively against local brands.

Global Economic Factors

Another important question is how global economic conditions, such as inflation, currency fluctuations, and trade policies, affect smartphone sales. Economic downturns typically lead to reduced consumer spending, which can hit premium brands like Apple harder than brands with a broader range of price points, as Samsung does.

Consumer Preferences and Brand Loyalty

Understanding shifts in consumer preferences is also crucial. The rise of the second-hand and refurbished phone market or the increasing environmental awareness among consumers can play roles in market dynamics. Maintaining brand loyalty in a rapidly evolving market is a challenge for all smartphone manufacturers.

Supply Chain and Production

Both companies face the challenge of managing complex international supply chains. Disruptions, whether from political tensions, natural disasters, or health crises like the COVID-19 pandemic, can have significant impacts. Samsung’s global manufacturing presence may offer it more flexibility in weathering such challenges compared to Apple’s more concentrated production in China.

Pros and Cons of Market Leadership

The advantages of Samsung’s market leadership include increased brand visibility and potentially higher sales volumes, which can lead to economies of scale and branding opportunities. However, remaining at the top requires continuous innovation and marketing investments, and the pressure to retain the top spot can lead to aggressive strategies that may affect long-term profitability.

Related Market Analysis

For further market insights and latest updates, readers can visit the main domain of Counterpoint Research at Counterpoint Research to explore their comprehensive reports and analyses.

The source of the article is from the blog mivalle.net.ar