Motorola Solutions, Inc. (NYSE:MSI) has seen an increase in holdings by Perigon Wealth Management LLC, according to the latest filing with the Securities & Exchange Commission. The institutional investor now owns 818 shares of Motorola Solutions, with a total value of $256,000. Other large investors, such as Norges Bank and Alphinity Investment Management Pty Ltd, have also recently modified their holdings of MSI.

In addition to changes in holdings, there has been recent insider activity at Motorola Solutions. SVP Cynthia Yazdi sold 4,744 shares of the company’s stock, while retaining 8,858 shares valued at approximately $2.96 million. This transaction was disclosed in a document filed with the Securities & Exchange Commission.

Shares of Motorola Solutions opened at $340.51 on Thursday. The company has a market cap of $56.57 billion, a PE ratio of 34.29, and a beta of 0.90. Motorola Solutions has a 1-year low of $269.64 and a 1-year high of $355.39.

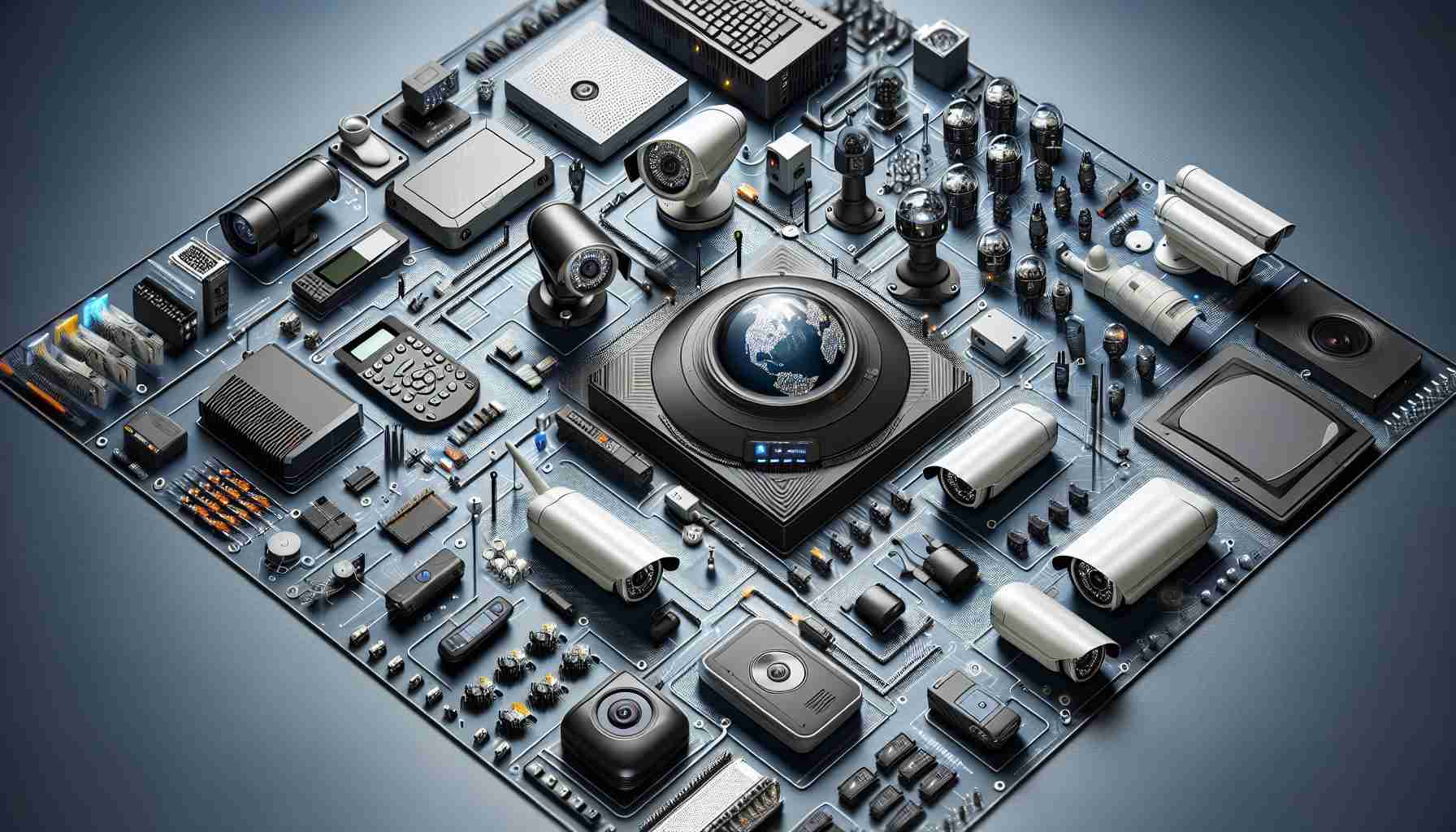

Motorola Solutions is known for providing public safety and enterprise security solutions. Their products and systems integration segment offers a wide range of infrastructure, devices, accessories, and video security devices and infrastructure. They also provide implementation and integration services for government, public safety, and commercial customers. With a focus on private communications networks and video security solutions, Motorola Solutions is dedicated to helping these customers manage their mobile workforce effectively.

Motorola Solutions recently reported strong earnings for the fourth quarter, beating the consensus estimate with earnings per share (EPS) of $3.90. The company’s revenue for the quarter was $2.85 billion, up 5.2% from the previous year.

Analysts have positive ratings for Motorola Solutions, with a consensus rating of “Moderate Buy” and an average price target of $348.38. The company also recently announced a quarterly dividend of $0.98 per share, indicating a 1.15% yield.

Motorola Solutions continues to be a leading provider of security solutions, with a focus on innovation and customer satisfaction. Their strong financial performance and positive outlook make them an attractive investment option in the communications equipment industry. For more information about Motorola Solutions and its recent activities, visit HoldingsChannel.com or consult the latest 13F filings and insider trades.

Motorola Solutions, Inc. is a leading provider of public safety and enterprise security solutions. The company’s products and systems integration segment offers a wide range of infrastructure, devices, accessories, and video security devices and infrastructure. They also provide implementation and integration services for government, public safety, and commercial customers.

One of the recent developments in Motorola Solutions’ stock holdings is an increase in holdings by Perigon Wealth Management LLC. The institutional investor now owns 818 shares of Motorola Solutions, with a total value of $256,000. Other large investors, such as Norges Bank and Alphinity Investment Management Pty Ltd, have also recently modified their holdings of MSI.

In addition to changes in holdings, there has been recent insider activity at Motorola Solutions. SVP Cynthia Yazdi sold 4,744 shares of the company’s stock, while retaining 8,858 shares valued at approximately $2.96 million. This transaction was disclosed in a document filed with the Securities & Exchange Commission.

Motorola Solutions has a market cap of $56.57 billion and a PE ratio of 34.29. The company’s stock has a 1-year low of $269.64 and a 1-year high of $355.39. Shares of Motorola Solutions opened at $340.51 on Thursday.

Motorola Solutions recently reported strong earnings for the fourth quarter, beating the consensus estimate with earnings per share (EPS) of $3.90. The company’s revenue for the quarter was $2.85 billion, up 5.2% from the previous year.

Analysts have positive ratings for Motorola Solutions, with a consensus rating of “Moderate Buy” and an average price target of $348.38. The company also recently announced a quarterly dividend of $0.98 per share, indicating a 1.15% yield.

In terms of the industry, the communications equipment industry is expected to experience steady growth in the coming years. With the increasing demand for public safety and security solutions, companies like Motorola Solutions are well-positioned to benefit from this trend.

However, there are some challenges that the industry faces. One of these challenges is the rapid pace of technological advancements. Companies need to invest in research and development to stay competitive and offer innovative solutions to their customers. Additionally, the industry is highly regulated, and companies must comply with various safety and security standards.

Overall, Motorola Solutions’ strong financial performance, positive outlook, and focus on innovation make it an attractive investment option in the communications equipment industry. For more information about Motorola Solutions and its recent activities, visit HoldingsChannel.com or consult the latest 13F filings and insider trades.

The source of the article is from the blog radiohotmusic.it