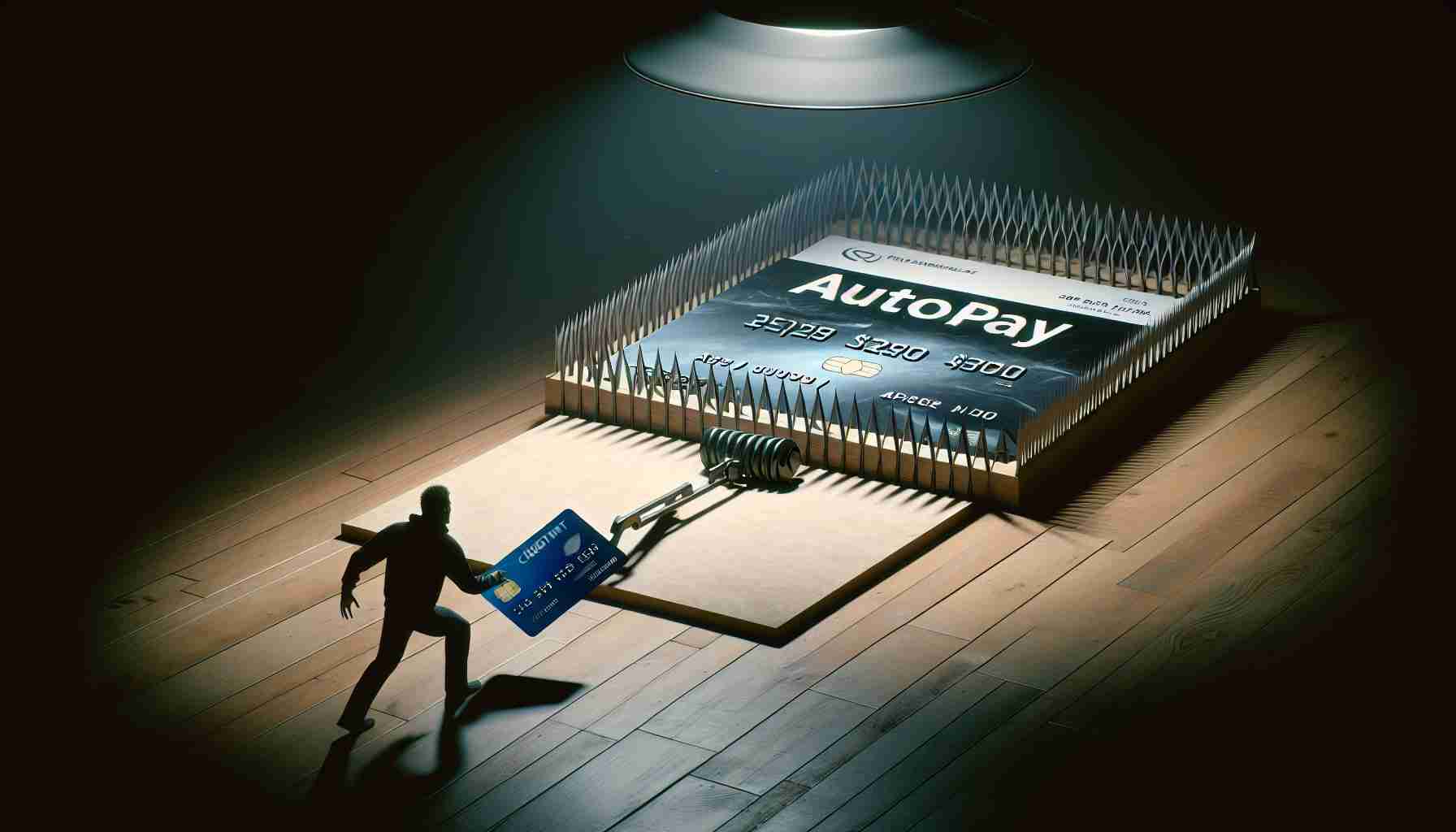

Automating your bill payments can be a convenient way to stay on top of your financial responsibilities. However, not all bills are suitable for autopay, and it’s important to be aware of the potential risks involved. Financial professionals caution against setting certain bills on autopay due to the unpredictable nature of their charges.

Utilities such as electricity and gas bills, in particular, may vary significantly from month to month. Grant Gallagher, a financial expert at Affinity Federal Credit Union, points out that errors on utility bills can result in overbilling, leading to potential financial disasters if set on autopay. By manually reviewing these bills each month, you can catch any mistakes or inaccuracies.

Another bill that shouldn’t be put on autopay is a gym membership. Alonso Rodriguez Segarra, CEO of Advise Financial, suggests reconsidering autopay for gym memberships, especially for new members. It’s essential to assess whether the gym is the right fit for your health journey before committing to automatic payments that can be challenging to cancel later on.

When it comes to smartphone bills, Betsy Hutchins from Forward Financial recommends avoiding autopay if you have a limited plan. Charges can quickly accumulate, and by reviewing your bill each month, you can assess your usage and potentially save money by adjusting your plan accordingly.

While credit cards are often put on autopay for convenience, it’s important not to overlook the benefits of reviewing your monthly charges. Financial consultant Gallagher emphasizes the need to check for incorrect charges or fraud regularly. Furthermore, if you carry a balance on your credit card, autopay can lead to unexpected increases in your minimum payment, catching you off guard.

In conclusion, while autopay can simplify bill management, it’s crucial to evaluate the suitability of each bill for automation. Variable bills like utilities, new gym memberships, limited smartphone plans, and credit card bills with balances require careful manual review to avoid potentially costly mistakes or unexpected payment increases. By understanding the risks involved, you can make informed decisions about which bills to set on autopay and which ones to manage manually.

FAQs:

1. What bills are not suitable for autopay?

Financial professionals caution against setting certain bills on autopay due to the unpredictable nature of their charges. Bills that are not suitable for autopay include:

– Utilities such as electricity and gas bills, which may vary significantly from month to month.

– Gym memberships, especially for new members who are unsure if the gym is the right fit for them.

– Smartphone bills with limited plans, as charges can quickly accumulate.

2. Why shouldn’t I put my utilities on autopay?

Setting utility bills on autopay can be risky due to the potential for errors and overbilling. Financial expert Grant Gallagher suggests manually reviewing these bills each month to catch any mistakes or inaccuracies.

3. Is it advisable to consider autopay for gym memberships?

CEO Alonso Rodriguez Segarra advises against autopay for gym memberships, especially for new members. It’s important to assess whether the gym is the right fit for your health journey before committing to automatic payments that can be challenging to cancel later on.

4. Should I avoid autopay for smartphone bills?

Financial advisor Betsy Hutchins recommends avoiding autopay for smartphone bills if you have a limited plan. By reviewing your bill each month, you can assess your usage and potentially save money by adjusting your plan accordingly.

5. Are there any risks with putting credit card bills on autopay?

While credit cards are often put on autopay for convenience, financial consultant Gallagher emphasizes the need to regularly check for incorrect charges or fraud. If you carry a balance on your credit card, autopay can also lead to unexpected increases in your minimum payment.

Definitions:

– Autopay: An automated payment method that allows for regular bill payments to be deducted automatically from a designated account.

– Utilities: Services such as electricity and gas that are provided to households or businesses for everyday use.

– Gym membership: A subscription or contract that grants access to a gym or fitness center for a specified period in exchange for a fee.

– Smartphone bill: The monthly charges for services and usage associated with a smartphone, including voice calls, data usage, and messaging.

– Credit card bill: The statement of charges and payments associated with a credit card account, including balances, fees, and interest.

Suggested related links:

– Affinity Federal Credit Union

– Advise Financial

– Forward Financial

The source of the article is from the blog cheap-sound.com