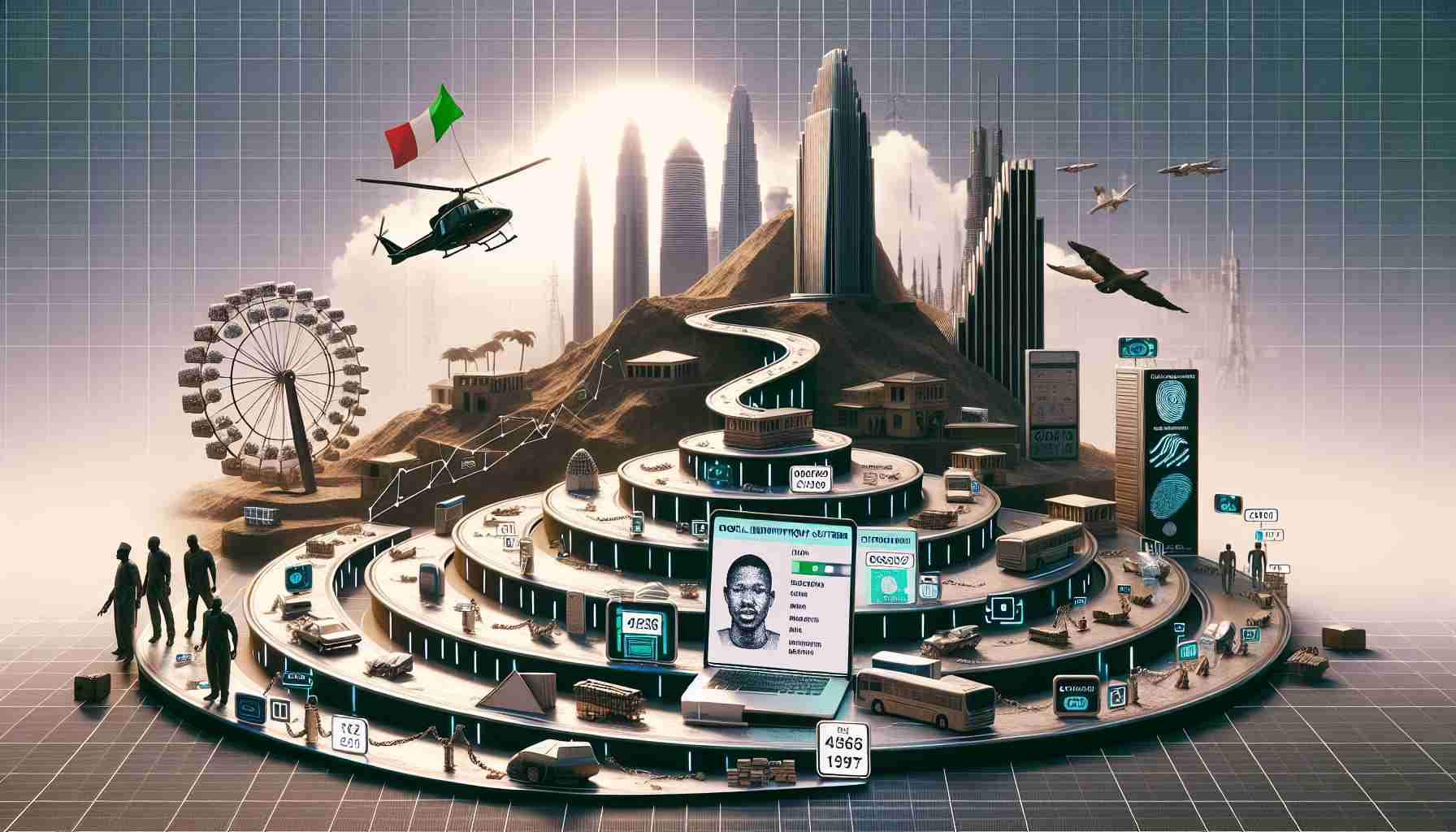

In today’s rapidly evolving digital era, the importance of establishing one’s identity as a fundamental requirement for social, political, economic, and cultural participation is increasingly understood. In Africa, where around 500 million people lack a legal identity document, the need for robust identification systems has never been greater. In response to this challenge, the Digital Identification and Finance Initiative (DigiFI) has been established, aiming to leverage digital payment and identification systems to improve the delivery of public services, governance, and financial inclusion across the continent.

The vision of DigiFI is to provide rigorous evidence of how African governments, private companies, and non-governmental organizations can harness the potential of digital identification and finance to improve the quality of life. DigiFI seeks to empower the most vulnerable groups in Africa, including rural residents, the poor, women, children, and other marginalized groups, through accessible and inclusive digital identification systems, supporting governments and policymakers in monitoring and evaluating relevant reforms.

Nigeria, as a case study, serves as an illustrative example of the challenges and opportunities associated with implementing digital identification systems in Africa. With a population of over 221 million residents by the end of 2023 and a diverse socio-economic landscape, Nigeria has witnessed the development of identification programs over the years since 2005, fraught with allegations of corruption, infrastructure limitations, and privacy concerns. However, the Nigerian government has shown renewed commitment to utilizing digital technology to streamline identification processes, combat poverty, and improve service delivery in collaboration with various stakeholders.

Digital identification systems offer several advantages over traditional analog systems. They provide more reliable methods of identifying and verifying individuals, reducing the risk of improper or incomplete customer due diligence (CDD). According to the World Bank report, digital identification systems can significantly enhance the accuracy and integrity of identification processes by utilizing advanced document verification technology and analyzing metadata from digital channels, such as GPS location or mobile device data.

Secondly, digital identification systems align with the vision of identity management as a continuous process, where an individual’s profile is continually updated using various data sources. This dynamic approach, known as identity proofing, ensures that identification data is accurate and up to date, enabling the application of appropriate risk-based controls to counter money laundering and terrorist financing. Digital identification systems have immense potential in addressing financial inclusion challenges. These systems can reduce costs and improve accessibility by replacing physical documents with digital verification methods, such as GPS technology for address confirmation or automating the verification process. An example is the Indian digital identification system Aadhaar, which significantly reduced the average customer verification cost from $15 to $0.50, demonstrating the transformative power of digital identification in promoting financial inclusion.

Delving into the context of Nigeria and examining the potential benefits and risks associated with digital identification systems, it becomes clear that the evolving landscape requires a balance of technological progress, regulatory frameworks, privacy concerns, and inclusive social approaches.

This article tells the story of digital identification projects in Nigeria, their impact on poverty alleviation, and implications for service delivery through stakeholder interviews and analysis of secondary sources. Valuable insights and lessons can be drawn from Nigeria’s experience, which can be useful for the broader African context, guiding future initiatives towards more inclusive, secure, and effective digital identification systems.

The following sections examine the history of digital identification in Nigeria, the government’s efforts to implement these projects, the benefits and risks they present, and everyday life examples that demonstrate their impact on individuals and communities. The research aims to provide a comprehensive picture of the current state of digital identification systems in Africa, while highlighting the opportunities and challenges they pose for inclusive development.

FAQ section based on key themes and information presented in the article:

1. What is the Digital Identification and Finance Initiative (DigiFI)?

DigiFI is an initiative that aims to leverage digital payment and identification systems to improve the delivery of public services, governance, and financial inclusion across the African continent.

2. What are the benefits of digital identification?

Digital identification offers more reliable methods of identifying and verifying individuals, reducing the risk of improper or incomplete customer due diligence. It can also lower costs and improve accessibility by replacing physical documents with digital verification methods.

3. How is the identification landscape potentially changing in Nigeria?

In Nigeria, the government has shown renewed commitment to utilizing digital technology to streamline identification processes, combat poverty, and improve service delivery. However, there are concerns regarding privacy issues and regulation.

4. What are the opportunities and challenges associated with digital identification in Africa?

Digital identification has the potential to address financial inclusion challenges by lowering costs and improving accessibility. However, it requires a balance of technological progress, regulation, privacy concerns, and social approaches.

5. What are the main insights from Nigeria’s experience?

Nigeria’s experience in digital identification can provide valuable insights and lessons that may be useful for other African countries in their pursuit of more inclusive, secure, and effective digital identification systems.

Key Terminology:

– Digital Identity: An identification system based on digital technology.

– Financial Inclusion: Access to financial products and services for all individuals, regardless of their economic status.

– Metadata Analysis: The process of analyzing and interpreting data about data, such as GPS location or mobile device data.

– Identity Proofing: A dynamic approach to identity management, where identification data is continuously updated using various data sources.

Suggested Related Links:

– DigiFI: Official website of the Digital Identification and Finance Initiative.

– World Bank: Official website of the World Bank, where digital identification systems are being studied.

– Aadhaar: Official website of the Indian digital identification system that has successfully promoted financial inclusion.

The source of the article is from the blog radiohotmusic.it