“`html

- Microsoft is leveraging AI and cloud computing to redefine its tech legacy.

- Significant earnings growth has boosted investor confidence in tech sectors.

- Microsoft’s partnership with OpenAI is crucial for advancing Azure’s capabilities.

- Azure is projected to potentially exceed $200 billion in annual revenue within a decade.

- Microsoft anticipates strong growth in the latter half of fiscal 2025 despite early constraints.

- Investors can expect double-digit revenue expansion and significant value returns.

- Those seeking faster returns may explore other AI investment opportunities.

“`

As the financial landscape evolves, certain giants in the tech industry are emerging as potential frontrunners for sustained success. Microsoft Corporation (NASDAQ:MSFT) is one such titan, poised to redefine its legacy with strategic advancements in AI and cloud computing. Earlier this year, the market was relatively calm as investors absorbed critical updates from major tech players, particularly around earnings that surprised many with a robust increase from prior forecasts.

With over 62% of S&P 500 companies closing their earnings reports for the season, the index has already noticed an unprecedented growth rate, signaling renewed confidence amongst investors. Among the crowd, Microsoft has secured its place as a pivotal figure in the tech realm, especially with its forward-thinking involvement in OpenAI. This investment is set to enhance Azure, Microsoft’s cloud service, solidifying its status as a leader in generative AI.

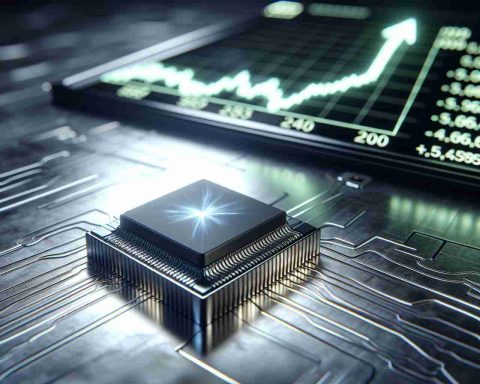

Despite infrastructure constraints projected to temper early fiscal results, experts suggest that Microsoft’s growth trajectory will rebound strongly in the latter half of fiscal 2025 as AI deployment intensifies. Notably, Azure, now Microsoft’s most lucrative segment, is predicted to potentially surpass $200 billion in annual revenue over the next decade.

For investors scouting for steadfast growth, Microsoft stands as a beacon — slated for continuous double-digit revenue expansion and substantial value return to its shareholders. Still, those hunting more aggressively priced opportunities in AI might find enticing alternatives offering speedier returns.

Takeaway: Microsoft’s strategy and prowess in technology sectors like AI and cloud are setting the stage for it to be a formidable stock in the coming years, though exploring broader AI opportunities might offer quicker wins.

Is Microsoft the Ultimate AI and Cloud Investment Choice?

The Rise of Microsoft as a Tech Powerhouse

Microsoft Corporation’s strategic advances in AI and cloud computing mark it as a frontrunner in the evolving financial and technological landscape. In recent times, Microsoft has surprised investors with earnings that exceeded expectations. With 62% of S&P 500 companies reporting substantial growth, particularly in tech, Microsoft’s forward-thinking initiatives, especially its involvement with OpenAI, have positioned it strongly in the market.

How Microsoft is Leveraging AI and Cloud Computing

1. AI Leadership with OpenAI:

– Microsoft’s collaboration with OpenAI strengthens its generative AI initiatives. This partnership is critical in advancing Azure’s capabilities, Microsoft’s cloud computing service.

– Experts predict that as AI deployment intensifies, Microsoft’s growth trajectory will significantly rebound, particularly in the latter half of fiscal 2025.

2. Potential of Azure:

– Azure stands as Microsoft’s most profitable segment. Its trajectory is optimistic, with expectations of potentially surpassing $200 billion in annual revenue over the next decade.

– Azure’s success is rooted in strategic investments and innovations in AI technologies.

Pros and Cons of Investing in Microsoft

Pros:

– Sustained Double-Digit Growth: Microsoft has shown consistent revenue expansion, promising strong returns for shareholders.

– Strategic Positioning in AI: The collaboration with OpenAI and advancements in AI technology provide a competitive edge.

– Resilience in Market Fluctuations: Despite obstacles, Microsoft maintains a robust recovery plan and future growth potential.

Cons:

– High Valuation: Microsoft’s stock might not be suitable for investors looking for lower-priced entry points.

– Dependence on AI Rollout Success: The anticipated growth relies heavily on the successful implementation and commercialization of AI technologies.

What’s Next for Investors?

Investors seeking steadfast growth and consistent returns may find Microsoft an attractive option. However, for those targeting quicker wins in the AI sector, exploring alternative emerging opportunities might be beneficial.

Market Forecast for Microsoft

– Prospects are strong for Microsoft’s growth in AI and cloud services.

– Experts suggest resilience and potential for market-leading status by mid-fiscal 2025.

Trends and Innovations in Microsoft’s Strategy

– Focus on Sustainability: Microsoft is integrating environmental consciousness into its operational strategies, aiming for carbon neutrality.

– Security Enhancements: Increased investment in digital security to protect data integrity across cloud services and AI products.

Conclusion

Microsoft’s role in AI and cloud computing is part of a broader strategic initiative that promises sustained growth. While the tech giant remains a solid choice for long-term investments, other faster-moving, less expensive stocks could offer attractive alternatives.

For further insights into Microsoft’s developments and market position, visit [Microsoft](https://www.microsoft.com).