Nvidia’s Innovative Drive: A Glimpse into the Future

An exciting forecast has emerged for Nvidia, as technological advancements surrounding the Blackwell NVL/GB200 are laying the groundwork for potential breakthroughs. These developments have not only sparked optimism in the industry but have also rekindled investor interest, following a dip in Nvidia’s stock price below the $130/share threshold.

Redefining Production with Cutting-Edge Innovations

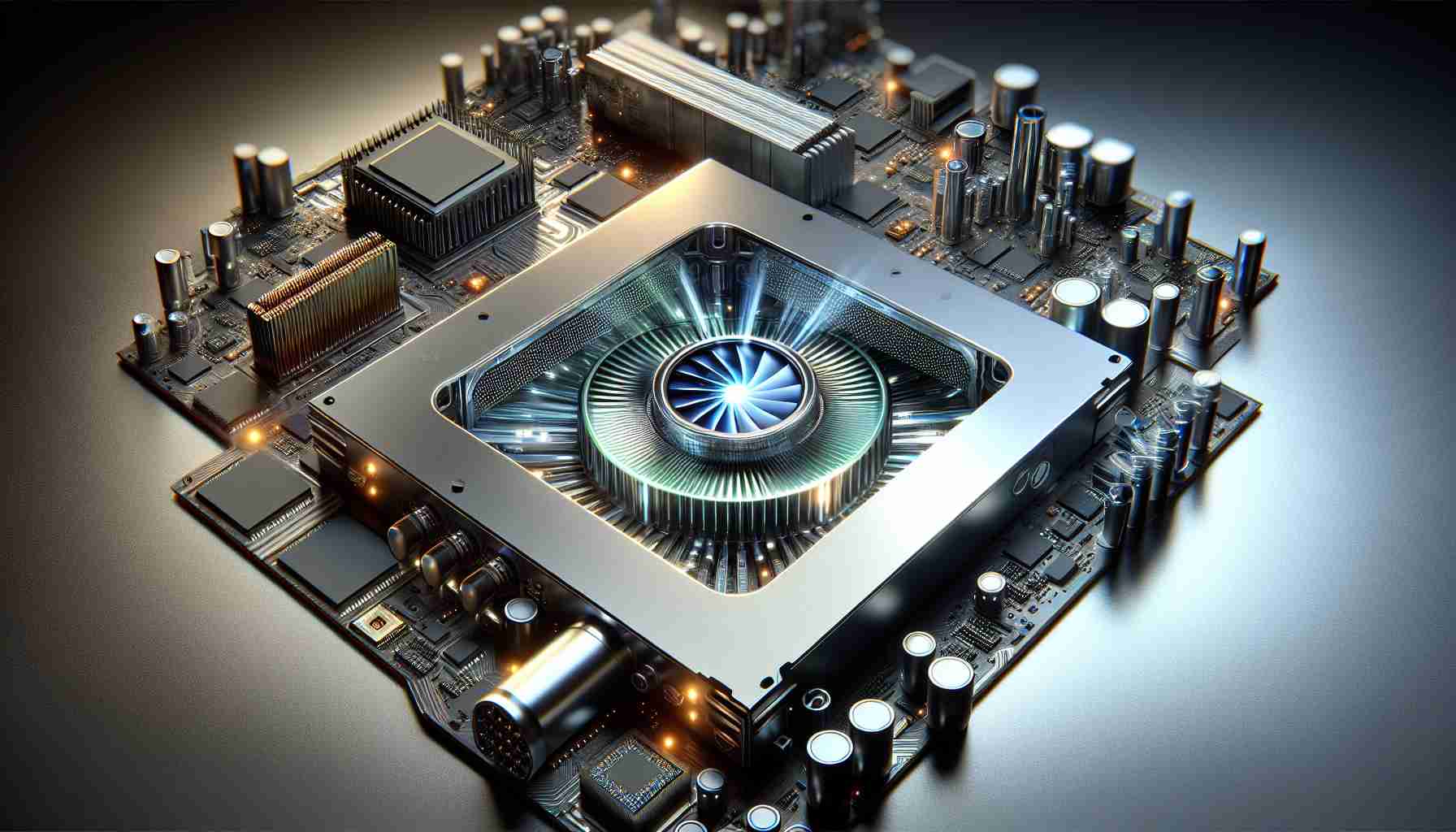

Trendforce’s latest insights reveal groundbreaking technological progress that Nvidia is employing to tackle previous hurdles related to cooling and thermal regulation. These strides signify a smooth trajectory towards achieving mass production goals, anticipated between the second and third quarters of 2025. Such technological prowess is solidifying Nvidia’s standing in the market, reflecting positively on its capabilities.

Cautious Strategies Forge Confidence

Mizuho’s in-depth analysis proposes that Nvidia’s revenue forecasts for early next year reflect a calculated conservatism, safeguarding against unforeseen production disruptions. This approach ensures stability, despite projections missing the $39-40 billion revenue bracket. Additionally, Citi analyst Atif Malik forecasts a growth in Nvidia’s cowos foundry capacity from 56% to 60% by 2025, indicating a forward-thinking production strategy poised to capture emerging demand.

Investor Enthusiasm and Future Prospects

With Nvidia’s shares having surged by 163% this year, analysts project sustained demand in sectors like high-performance computing and AI. Nvidia’s strategic focus on innovation and expansion positions the company strongly to exploit forthcoming opportunities, heralding a promising future for the tech giant.

Nvidia’s Technological Renaissance: The Implications for the Future

The technological advancements spearheaded by Nvidia, particularly with its Blackwell NVL/GB200, promise to transform industries by addressing challenges like cooling and thermal regulation. These innovations are not merely technical triumphs; they herald significant environmental, economic, and societal impacts, reshaping the future landscape.

Environmental Impact through Innovation

Advanced cooling and thermal regulation technologies play a crucial role in reducing the carbon footprint of high-performance computing systems. By improving efficiency, Nvidia’s cutting-edge solutions mitigate the energy consumption of data centers, which are notorious for their massive electricity usage and carbon emissions. By fostering more sustainable computing practices, these developments contribute directly to combating climate change, reflecting a crucial step towards a more eco-friendly technological future.

Economic Growth and Resilience

Nvidia’s cautious yet ambitious production strategies not only stabilize market presence but also drive economic growth. The projected expansion of cowos foundry capacity and precise revenue forecasts ensure that Nvidia can adapt swiftly to market shifts. This adaptability fosters investor confidence and economic resilience, even amidst unpredictable global economic conditions. By spearheading innovations in AI and high-performance computing, Nvidia secures a pivotal role in the digital economy, establishing a bedrock for future technological industries.

Advancements for Humanity

As Nvidia continues to innovate, the ripple effects extend beyond corporate growth to influence humanity at large. High-performance computing and AI drive advancements across various sectors, including healthcare, automotive, and education, enhancing quality of life and societal capabilities. The more efficient processing power enables breakthroughs in drug discovery, autonomous driving, and personalized learning, illustrating the breadth of impact such technologies possess.

A Connected Future

The intersections of environmental sustainability, economic stability, and societal benefits illustrate a future where technological advancements like those driven by Nvidia do not merely serve corporate interests but align with global needs. As Nvidia leads in these domains, it sets a precedent for technology’s potential to foster a future where human progress and environmental stewardship can coexist, ultimately shaping a balanced and integrated world.

Nvidia: Powering the Future of Technology with AI and Computing Innovations

Nvidia’s Strategic Innovations: Driving Next-Level Tech Achievements

As Nvidia forges ahead in technological innovation, the Blackwell NVL/GB200 advancements are setting the stage for transformative breakthroughs across the tech industry. The implications of these advancements suggest a robust future, sparking renewed investor confidence as Nvidia navigates beyond past stock dips.

Unveiling Nvidia’s Innovative Features and Use Cases

Nvidia’s recent technological strides are not just about tackling cooling and thermal challenges but also about enhancing the capabilities of its products for diverse applications. The company’s focus on high-performance computing and artificial intelligence extends the use cases for its products, from powering data centers to enabling autonomous vehicles. Nvidia’s technologies are integral in the advancement of machine learning models and deep learning algorithms, underpinning innovations in various fields like medicine, automotive, and entertainment.

Market Analysis: Navigating Challenges with Strategic Foresight

Analysts at Mizuho recognize Nvidia’s balanced approach toward revenue forecasts, highlighting the company’s strategic caution amid potential production disruptions. Despite early-year projections that fall short of the $39-40 billion revenue bracket, Nvidia’s strategy entails expanding its cowos foundry capacity, indicative of a forward-thinking attitude in capturing future market demand. This growth from 56% to 60% anticipated by 2025 underscores Nvidia’s commitment to meeting the escalating demands of technological integration.

Pros and Cons of Nvidia’s Technological Pathway

Pros:

– Continued innovation in AI and computing enhances technological capabilities.

– Expansion in foundry capacity to meet rising consumer and enterprise demands.

– Strategic conservatism in financial forecasting stabilizes market confidence.

Cons:

– Potential risks tied to unforeseen production and supply chain disruptions.

– The balance between rapid innovation and maintaining stable revenue growth can be challenging.

Future Predictions: Sustained Growth and Emerging Opportunities

Investor enthusiasm is high, driven by Nvidia’s significant share growth and the projection of sustained demand. The tech giant’s expanding influence in sectors such as AI positions it to capitalize on future opportunities, promising a dynamic growth trajectory. Analysts visualize Nvidia leading the charge in new technological domains, further cementing its dominance in the global tech arena.

For more about Nvidia’s innovations and market endeavors, visit the official link name.