In 2024, artificial intelligence (AI) remained the defining trend, shaping the future of businesses and technology landscapes. Companies embraced transformative algorithms, while cloud providers and chipmakers invested heavily to meet increasing AI demands. However, the rush to invest in AI-related firms led to inflated stock valuations, presenting challenges for some investors. Despite this, certain AI stocks are poised for significant growth in 2025.

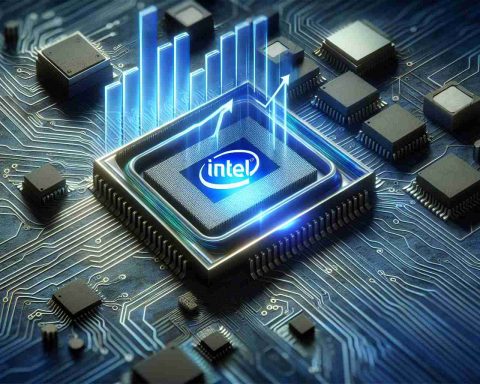

Advanced Micro Devices (AMD) is gaining momentum against Nvidia’s dominance in the data center GPU market. AMD’s Instinct series AI GPUs and Epyc CPUs are experiencing unprecedented demand, with high-profile clients expanding their use of AMD’s MI300X accelerators. The company reported a remarkable 18% revenue growth in the third quarter, driven by its AI-centric data center chips. While gaming revenue has been a setback, AMD’s stock valuation is seen as an opportunity, with experts predicting a potential doubling of its stock price.

Broadcom stands out in the technology sector with its diverse semiconductor and infrastructure software solutions. As a key player in data centers, where AI processing thrives, Broadcom continues to excel. The company’s recent 51% revenue surge highlights its integral role in the AI ecosystem. Analysts foresee its AI revenues skyrocketing to between $60 billion and $90 billion by 2027, establishing Broadcom as a critical component in AI advancements.

Micron Technology has quietly become a major force in AI innovation. Renowned for its memory and storage chips, Micron’s entry into the high-bandwidth memory market with the HBM3e chip proved successful. Its collaboration with Nvidia on the H200 Tensor Core GPUs has propelled Micron to record revenue levels, reflecting the strong demand for its data center solutions.

These companies symbolize the AI revolution’s growth potential, offering investors promising avenues in the ever-evolving AI landscape.

AI Stocks to Watch: What Makes AMD, Broadcom, and Micron Technology Stand Out?

As we look toward 2025, the advancements in artificial intelligence (AI) remain at the forefront of technological innovation, driving significant changes across various industries. Companies are not only adopting AI to boost efficiency and productivity, but they are also investing heavily in AI infrastructures, data centers, and semiconductors. Here, we delve into the remarkable progress seen in key players, Advanced Micro Devices (AMD), Broadcom, and Micron Technology, as they position themselves at the cutting edge of AI technology.

Advanced Micro Devices (AMD): A Rising Star in the Data Center Market

With AMD making strides against Nvidia’s long-standing dominance, the company is poised to reshape the data center landscape. AMD’s Instinct series AI GPUs and Epyc CPUs have captured the interest of major clients who are expanding their use of the MI300X accelerators. A notable aspect of AMD’s growth is its remarkable 18% revenue increase in the third quarter of 2024, predominantly driven by its commitment to AI-centric data center solutions. While AMD experienced dips in gaming revenue, experts view the current stock valuation as a promising opportunity, predicting a potential doubling of its stock price.

Pros:

– Increased demand for AI-specific GPUs and CPUs.

– Strong growth in AI-centric revenues.

Cons:

– Setbacks in gaming revenue.

Predictions:

– A potential significant increase in stock value due to data center demand.

Broadcom: The Semiconductor Giant’s AI Revenue Surge

Broadcom continues to make a substantial impact in the technology sector, particularly in data centers where AI operations are critical. The company’s impressive 51% revenue growth is testament to its pivotal role in the AI ecosystem. Analysts predict that Broadcom’s AI revenues could skyrocket to between $60 billion and $90 billion by 2027, which would cement its position as a pivotal player in AI advancements.

Features:

– Dominance in semiconductor and infrastructure software.

– Key investments and growth in AI data center solutions.

Pros:

– Integral role in the data center and AI processing markets.

– Rapid revenue growth attributed to AI innovations.

Micron Technology: A Quiet Innovator in AI Memory Solutions

Micron Technology has carved out a significant niche with its groundbreaking work in memory and storage chips. Notably, its HBM3e chip has made a substantial impact on the high-bandwidth memory market. Micron’s partnership with Nvidia on the H200 Tensor Core GPUs is a clear indicator of its prowess, leading the company to record-breaking revenue levels.

Innovations:

– Development of high-bandwidth memory solutions like HBM3e.

– Strategic collaboration with Nvidia.

Market Insights:

– Strong demand for memory and data center solutions predicts sustained growth.

Security Aspects:

– Partnerships with leading AI companies to ensure robust, cutting-edge solutions.

Conclusion

AMD, Broadcom, and Micron Technology epitomize not only the potential of AI innovation but also provide investors with promising opportunities in the rapidly evolving AI landscape. Their current trajectories suggest that these companies will continue to dominate and innovate in their respective areas, offering exciting prospects for the future of AI and technology as a whole. For those looking to delve deeper into the technological advancements and market strategies of these industry leaders, visit the respective official domains: AMD, Broadcom, and Micron Technology.