Yongxing Special Materials Technology Ltd (SZSE:002756) has caught the market’s attention with an impressive 22% rise in its stock price over the last three months. This surge prompts a closer look at the company’s financial health, specifically its Return on Equity (ROE).

Understanding ROE

ROE is a key measure of financial performance, revealing how effectively a company generates profit from shareholders’ investments. For Yongxing, the ROE stands at 11%, calculated from a net profit of CN¥1.4 billion against shareholders’ equity of CN¥13 billion in the year leading to September 2024. This indicates the company earns CN¥0.11 for every CN¥1 of equity.

Comparative Growth Analysis

While an 11% ROE might seem modest, it significantly exceeds the industry average of 7.5%. Furthermore, Yongxing’s net income has soared by 42% over five years, dwarfing the industry’s 9.8% growth rate during the same period. This exceptional performance suggests other growth drivers, possibly a low payout ratio or positioning within a booming industry sector.

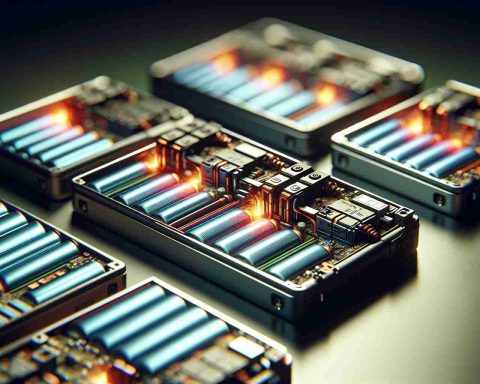

Profit Reinvestment Strategy

The company retains 68% of its profits, with a payout ratio of 32%, underscoring a strategic reinvestment into its business. Despite future projections indicating a rise in payout ratio to 43%, the ROE is expected to remain stable.

Overall, Yongxing Special Materials Technology continues to display robust growth through efficient profit use and strategic investments. However, future growth rates might slow, as suggested by analyst forecasts. Investors are encouraged to explore our detailed analysis to understand potential implications on stock valuation.

Why Yongxing Special Materials Technology is Outperforming the Industry

In recent months, markets have been abuzz with the impressive performance of Yongxing Special Materials Technology Ltd (SZSE:002756), as its stock price leaped by 22% over the past three months. Such a surge invites a deeper exploration into the company’s strategic maneuvers and financial health, specifically focusing on its Return on Equity (ROE) and growth strategies. Here’s what investors need to know that goes beyond the basics.

Key Insights into Yongxing’s ROE

Return on Equity (ROE) is a crucial financial metric that offers insight into a company’s efficiency in utilizing its equity base to generate profits. Yongxing’s ROE stands at an impressive 11%, significantly outstripping the industry average of 7.5%. Such a figure may seem modest but is noteworthy when placed in the context of industry norms. This elevated ROE points to effective management practices and judicious use of company resources.

Growth Trajectory and Industry Positioning

Yongxing’s net income has experienced a remarkable growth rate of 42% over five years, compared to a much slower industry average growth of 9.8%. This discrepancy presents the company as a leader in its sector, benefiting likely from strategic initiatives and possibly its positioning in a favorable market segment. This growth outperformance is bolstered by their strategy of retaining profits for reinvestment, with a payout ratio of 32%.

Strategic Profit Reinvestment and Future Prospects

Yongxing Special Materials Technology Ltd has adopted a profit reinvestment strategy, retaining 68% of its earnings to fuel further business development. Notably, the company plans to increase its payout ratio to 43% in the future while maintaining a stable ROE. This potential rise suggests Yongxing is preparing for sustained long-term growth, even amidst predictions of slowing growth rates.

Market Predictions and Investment Considerations

Analyst forecasts suggest potential moderation in growth rates, but Yongxing has positioned itself strongly through its strategic profit deployment and superior performance metrics. For investors, understanding these dynamics will be crucial. The company’s ability to maintain robust performance in the face of industry pressures speaks to its resilience and strategic acumen.

For a comprehensive understanding of how these strategies might affect Yongxing’s future stock valuation, investors are encouraged to delve deeper into market analyses. The positive outlook, despite potential hurdles, makes Yongxing a significant player to watch in the materials technology sector.

For more information on similar industry performers and emerging market trends, visit the related resources through this link to Shenzhen Stock Exchange, where Yongxing Special Materials Technology Ltd is listed.