In a recent development, Apple Inc. may soon resume sales of the iPhone 16 in Indonesia. This follows President Prabowo Subianto’s nod to a $1 billion investment proposal from the American tech giant, sources familiar with the situation report.

Indonesia had halted iPhone 16 sales, citing Apple’s non-compliance with domestic content policies for electronic goods. However, after a private meeting over the weekend, the Indonesian government began leaning towards accepting Apple’s investment offer. During this discussion, President Prabowo encouraged his cabinet to pursue more foreign investments, which Apple’s proposal promises to deliver.

A significant component of Apple’s strategy involves its plan to establish new manufacturing setups in Indonesia. One such venture includes a facility in Batam for producing AirTags. Scheduled to employ approximately 1,000 workers initially, this plant will contribute to 20% of the global AirTag production. Batam was strategically selected for its free-trade zone advantages, minimizing costs on taxes and import duties.

In addition to Batam, Apple intends to open a factory in Bandung to manufacture other accessories and launch Apple academies to nurture local talent in tech skills like coding.

While Prabowo’s administration is keen to finalize this agreement, there’s no fixed timeline for resuming iPhone 16 sales, and potential policy reversals loom over the discussions.

If the deal materializes, it would mark a significant diplomatic win for Prabowo and signal successful efforts in attracting foreign companies to boost local industry, although it could also set a precedent that may deter other firms afraid of government pressure tactics.

Apple’s Bold Investment Move: Building Factories in Indonesia to Resume iPhone 16 Sales

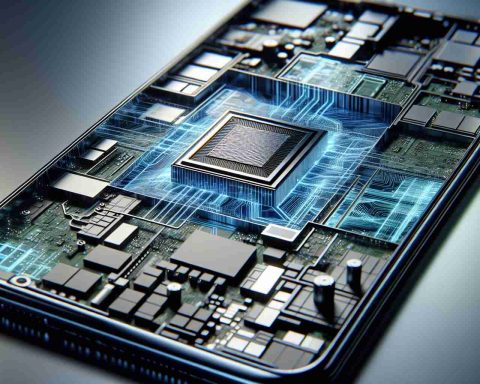

In a strategic shift to restore its market presence in Indonesia, Apple Inc. has proposed a $1 billion investment initiative that could potentially rekindle sales of the iPhone 16 in the Southeast Asian nation. This ambitious proposal underscores Apple’s commitment to aligning with Indonesia’s domestic content policies while seizing the opportunity to expand its manufacturing capabilities.

Apple’s plan includes establishing key manufacturing facilities, with a focus on the strategically located Batam Island. This new plant is set to significantly bolster Apple’s global supply chain by contributing to 20% of worldwide AirTag production. Batam’s advantages as a free-trade zone offer the tech giant a unique opportunity to minimize costs related to taxes and import duties, thereby enhancing operational efficiency.

Beyond Batam, Apple is eyeing Bandung as a promising site to develop a factory dedicated to the production of various Apple accessories. This move is not just about product manufacturing; it reflects Apple’s broader vision of fostering innovation and skill development in Indonesia. The proposed Apple academies aim to equip local talent with essential coding and tech skills, solidifying the foundation for a skilled workforce that can propel the nation into the digital age.

Pros and Cons of Apple’s Investment Strategy in Indonesia

# Pros:

– Economic Growth: The establishment of manufacturing plants and academies promises job creation and economic stimulation.

– Skill Development: Apple’s academies will nurture local talent, potentially leading to a skilled workforce boost in tech-related fields.

– Global Supply Chain: Increased production capacity in Indonesia is poised to strengthen Apple’s global supply components.

# Cons:

– Policy Instability: Ongoing negotiations and potential policy reversals could hinder the initiative’s progress.

– Local Business Competition: This large influx of foreign investment could overshadow local companies, leading to market imbalances.

Market Analysis: Implications for Apple’s Global Strategy

Apple’s investment aligns with a growing trend of tech giants expanding their manufacturing footprints in Asia beyond China. Indonesia’s rich resources and burgeoning tech ecosystem present a lucrative opportunity for companies seeking diversification. This move could set a benchmark for other multinationals considering similar expansions.

However, there are risks associated with relying on favorable policy environments in emerging markets. Indonesia’s initial halt on iPhone 16 sales emphasizes the importance of compliance with local regulations for sustained market success.

Predictions: A New Horizon for Tech Manufacturing

Should this deal come to fruition, it could mark a pivotal moment in Apple’s market strategy and Indonesia’s industrial landscape. By establishing a reliable manufacturing base in the region, Apple could reduce dependency on existing suppliers and enhance its resilience amidst global supply chain disruptions. This initiative also positions Indonesia as an emerging hub for tech manufacturing, potentially attracting more global players in the future.

Stay tuned for updates on this evolving situation as Apple navigates the complexities of international investments and local policy negotiations. For more insights into Apple’s global projects and market presence, explore the official Apple website.