Nvidia has truly dazzled its investors with a staggering 736% increase in its stock price over the past two years. The remarkable surge is closely tied to Nvidia’s critical role in the flourishing artificial intelligence (AI) industry, specifically in the AI chip market. The company’s stellar performance has been driven by massive revenue growth, largely attributed to its monopoly-like status in the sector.

Nvidia’s strategic maneuvers are positioning it to continue this impressive performance in the coming years. Most recently, the company posted a groundbreaking $35.1 billion in revenue for the fiscal third quarter of 2025, a 94% increase compared to the same period last year. This was achieved through a remarkable 112% growth in data center revenue, which soared to $30.8 billion.

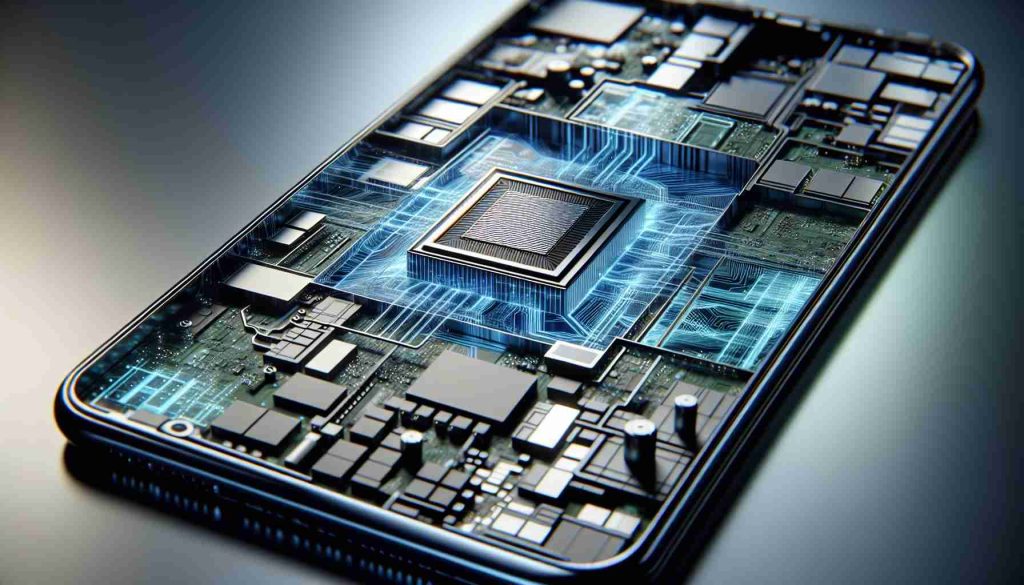

The enthusiastic market response to Nvidia’s new Blackwell processors has contributed significantly to its financial success. These AI chips deliver a 2.2 times boost in performance over the earlier Hopper models, paired with reduced computing costs. To address the “staggering demand,” Nvidia is ramping up production, even if it temporarily affects profit margins.

Projections indicate that Nvidia’s gross margin could climb back to the mid-70% range once Blackwell production stabilizes. With the anticipated launch of Rubin architecture chips by 2026, manufactured using a cutting-edge 3-nanometer process, Nvidia is poised to maintain its lead in the AI chip sector.

As the AI chip market races towards a projected $500 billion in revenue by 2028, Nvidia’s dominance could translate into substantial growth. Investors are eyeing an opportunity for significant gains, with stock valuations appearing favorable for long-term growth potential.

How Nvidia’s Dominance in AI Chips Influences Global Tech Landscapes

Introduction: The Ripple Effect of Nvidia’s Success

The meteoric rise of Nvidia, highlighted by a 736% increase in stock value over the past two years, signifies more than just a triumph in the stock market. It underscores a pivotal transformation in the global technological and economic landscapes. The company’s impressive foothold in the AI chip market is reshaping industries, influencing geopolitical strategies, and impacting everyday life.

Nvidia and the AI Race: Opportunities and Challenges

Nvidia’s success is deeply intertwined with the burgeoning artificial intelligence industry. As the market anticipates reaching $500 billion in revenue by 2028, Nvidia’s near-monopoly poses intriguing advantages and potential drawbacks.

Opportunities:

1. Innovation Acceleration: Nvidia’s cutting-edge Blackwell processors promise to fuel innovation across sectors, from healthcare to automotive. Enhanced AI capabilities can significantly improve medical diagnostics, autonomous vehicles, and smart cities.

2. Economic Growth: Countries hosting Nvidia’s operations may see economic boosts, creating jobs and attracting tech talent. This growth extends to ancillary industries, like semiconductor manufacturing and data center operations.

3. Educational Advancements: As Nvidia’s AI technologies become more accessible, schools and universities might integrate AI courses, fostering a new generation skilled in AI technology.

Challenges:

1. Geopolitical Tensions: Nvidia’s dominance could intensify global tech rivalries. As countries strive for tech sovereignty, Nvidia’s chips may become pivotal in international negotiations or tech embargoes.

2. Market Disparity: Nvidia’s stronghold over the AI chip market could stifle competition, potentially leading to higher costs for consumers and slower innovation from smaller companies.

3. Environmental Concerns: The increased demand for AI chips requires heightened production, which could have environmental implications. Concerns revolve around e-waste and the energy-intensive nature of data centers.

The Personal Impact: How Individuals Are Affected

The evolution of AI chips by Nvidia is not an isolated business phenomenon; it has tangible effects on consumers and professionals alike.

– For Consumers: AI-enhanced devices may become more prevalent and affordable, from smarter home assistants to personalized digital services. However, there are concerns about privacy as AI systems analyze more personal data.

– For Professionals: The rise of AI can redefine jobs, requiring workforce reskilling. Nvidia’s chips might also enable creatives and engineers to push the boundaries of digital arts and engineering solutions.

Is There A Limit to Nvidia’s Growth?

The question remains: can Nvidia sustain such rapid growth? As the company looks towards manufacturing Rubin architecture chips using a 3-nanometer process by 2026, these technological leaps suggest potential longevity. Yet, industry experts caution about overreliance on a single company for critical tech infrastructure.

Conclusion: Navigating Nvidia’s AI Future

In conclusion, Nvidia’s impressive advancements and their far-reaching consequences highlight the double-edged nature of technological monopolies. While offering vast opportunities, they also come with substantial responsibilities and risks that must be managed to ensure equitable progress.

For further insight into Nvidia’s developments and the tech industry, you can visit the official Nvidia website or explore general tech industry updates on TechCrunch.