In a whirlwind of trading activity at 9:30 a.m. on the 26th, elite investors strategically shifted their portfolios with significant net purchases and sales. During this time, Samsung Electronics, Peptron, and Alteogen saw keen interest from the top 1% of investors, reflecting their aggressive strategies. Conversely, Daedong, Hanwha Aerospace, and Hanwha Ocean were unloaded, signaling a pivot in market expectations.

Leading the Charge: Samsung Electronics

Mirae Asset Securities reported the morning spike in Samsung Electronics purchases by top-performing investors. The buying frenzy appears linked to potential Nvidia HBM (High Bandwidth Memory) supply deals. As of 9:30 a.m., Samsung shares jumped to 58,800 won, showing a 1.55% increase. Experts speculate that the anticipation of accelerated memory chip deliveries is driving the rally.

Adding credibility to this surge, Nvidia’s CEO has publicly stressed the urgency of approving Samsung’s AI memory chip deliveries. Samsung’s recent financial maneuvers, including active treasury stock purchases, suggest a stabilizing phase for its stock.

Pharmaceuticals in Focus: Peptron’s Promising Plans

Next in line for hefty investments was Peptron, buoyed by optimistic clinical trial strategies. Shinhan Investment & Securities highlighted Peptron’s ambitious timeline for PT404, forecasting Phase 1 trials by 2025. This bold move could potentially double Peptron’s market value compared to historical comparisons in the biotech field.

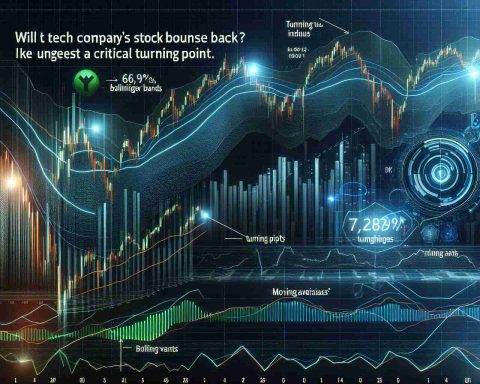

Cash Out While Ahead: Daedong’s Decline

In stark contrast, Daedong faced heavy selling from profit-hungry investors. Following buzz around geopolitical developments and potential peacemaking in Ukraine, Daedong’s stock enjoyed a speculative boost. However, high-yield investors seemed to capitalize on these temporary gains, opting to secure profits early.

Why Elite Investors Are Betting Big on Samsung and Abandoning Hanwha: Financial Tug of War

The world of elite investing is often a careful dance of strategy, timing, and foresight. As demonstrated during a recent whirlwind of trading activity, top investors reshuffled their portfolios with staggering precision. While companies like Samsung Electronics surged in popularity, others such as Hanwha Aerospace and Hanwha Ocean found themselves falling out of favor. This shift isn’t merely about numbers on a screen; it could have profound implications for the economy and stakeholders involved.

The Samsung Electronics Surge: Implications Beyond the Trade Floor

The heavy investment in Samsung Electronics, largely spurred by potential Nvidia HBM (High Bandwidth Memory) supply deals, reflects a deeper confidence in the tech giant’s future. This move is not just about seizing short-term gains. If successful, Samsung’s ventures into AI memory chips could significantly bolster South Korea’s tech exports, potentially affecting everything from local employment rates to global stock market trends.

However, investing in technology carries inherent risks. Historically, rapid technological advancements can make existing products or innovations obsolete overnight. Could Samsung’s aggressive push in AI memory chips face such a challenge, or will it revolutionize the industry?

What Makes Peptron a Biotech Darling?

Peptron’s rising appeal among the top 1% of investors suggests that the biotech sector is becoming a hotbed for strategic investments. The optimism surrounding Peptron’s clinical trial strategies, specifically for PT404, showcases investor confidence in the company’s pioneering endeavors. Success in this arena could open new doors in medical treatments, potentially transforming the landscape of healthcare.

Yet, the question remains: Are investors too optimistic about the timeline and success of these trials? The path to medical breakthroughs is fraught with unforeseen regulatory and scientific hurdles. The potential increase in market value is substantial, but so are the risks.

Controversial Divestment: The Fall of Hanwha

Hanwha Aerospace and Hanwha Ocean have seen a decline in investor interest, painting a complex picture. This shift might reflect changing priorities within the sectors. Hanwha, once a staple for conservative, long-term gains, may not align with the fast-moving strategies of elite investors now pivoting towards high-growth areas.

Could this exodus reflect a broader sentiment about the future of traditional aerospace and defense industries? The reduced focus on these sectors suggests a possible reevaluation of global defense needs or a reaction to emerging technologies that may render traditional models outdated. This evolution could impact regional economies that rely heavily on manufacturing and defense contracts.

Advantages and Disadvantages of Such Strategic Shifts

The advantages of these strategic investments are clear: aligning with growing sectors can lead to substantial financial returns and foster developments that drive innovation and employment. Sectors like technology and biotech are poised to lead future market growth, offering promising opportunities.

Conversely, there’s a disadvantage in concentrating efforts into a few high-risk sectors. The volatility in tech and biotech could result in significant financial losses if companies fail to meet expectations or adapt to changes quickly. Moreover, divesting from stable industries could lead to broader economic repercussions, such as job losses or decreases in industrial output.

Exploring Further: Is There a Middle Ground?

Do these investment trends imply a future where only tech and biotech flourish? Is there potential for traditional industries to adapt and thrive alongside emerging ones? Investors and companies alike must consider whether a balanced portfolio can offer better security and long-term gains.

For those looking to study these phenomena further or to understand the dynamics of sector-focused investing, consider exploring resources and insights from Bloomberg and Reuters. These platforms provide comprehensive coverage and analysis of market trends and investor behavior.

In closing, as we observe these strategic shifts in elite investing, one thing remains clear: the stakes are higher than ever, and the implications of these moves will be felt far beyond the trading floors, influencing economies and industries on a global scale.