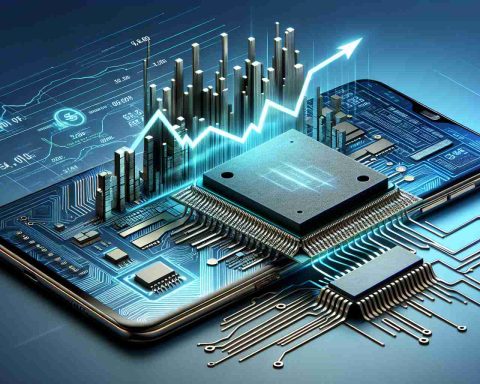

In a surprising twist, Nvidia Corp experienced a 3% dip in its stock during after-hours trading despite posting impressive earnings. The initial market reaction had investors scratching their heads, given the stellar numbers reported by the tech behemoth.

By the start of trading on Thursday, Nvidia shares showed their characteristic volatility. They swung between gains and losses, initially opening 5% higher before stabilizing and then dipping by mid-morning, settling at $144.10—a decrease of 1.23%.

Stellar Performance, Tempered Market Reaction

Nvidia, based in Santa Clara, California, delivered an impressive earnings report with an 8% increase in earnings per share and a 6% revenue beat against previous estimates. Markedly, their revenue surged by nearly 94% year-over-year, driven by an unrelenting demand for AI chips.

Despite the volatile trading session, Nvidia’s stock indicators reveal a strong underlying resilience. The company’s shares remain above key moving averages, which suggests a solid foundation for future growth:

– 8-day SMA: Nvidia’s current price of $145.29 exceeds the $145.20 average, indicating a bullish trend.

– 20-day SMA: Trading above $142.79, reinforcing upward momentum.

– 50-day SMA: Outperforming its $133.52 average, showcasing positive momentum.

– 200-day SMA: The stock price remains significantly above this average at $110.41, showing long-term strength.

What lies ahead for Nvidia is an intriguing question as the company continues to navigate investor expectations amidst its soaring ambitions in the AI sector. Investors remain keenly aware of the stock’s potential to maintain its impressive trajectory.

Nvidia’s Rollercoaster Ride: Beyond Earnings and Stock Fluctuations

The financial world stood in awe as Nvidia Corp, a pioneering force in technology, unveiled stellar earnings, only to see its stock take a surprising dip. While headlines buzz about the 3% decline during after-hours trading, there’s a whole new narrative unfolding beneath the surface that affects not just investors, but also communities and global industries.

The Impact of AI and Nvidia’s Leadership

While the focus remains on Nvidia’s financial fluctuations, the core driver of its growth is the rapidly evolving AI industry. Nvidia’s dominance in producing powerful AI chips isn’t just a market triumph; it’s reshaping industries, from healthcare to automotive, by enabling enhanced machine learning capabilities and automation.

AI’s integration into everyday life could potentially improve medical diagnostics, lead to autonomous driving developments, and contribute to more efficient energy consumption. However, this also raises questions about job displacement and the ethical considerations of AI’s increasing presence in society.

Could AI Influence Global Economies?

Nvidia’s role in advancing AI doesn’t just bolster its market position but could disrupt global economic landscapes. Countries investing in AI development and infrastructure feel the ripple effects of companies like Nvidia leading innovation. On the flip side, nations slower to adopt AI technologies may find themselves at a competitive disadvantage.

This economic influence underscores a notable debate: Should governments invest more aggressively in AI education and infrastructure, aligning with industry leaders to secure future prosperity?

Advantages and Disadvantages of Nvidia’s Influence

Advantages:

1. Technological Advancement: Nvidia’s technology accelerates innovation across industries.

2. Economic Growth: AI progress driven by companies like Nvidia fosters new business opportunities.

3. Improved Quality of Life: AI technologies can solve complex problems, impacting healthcare, transportation, and logistics.

Disadvantages:

1. Job Displacement: Automation threatens traditional jobs, necessitating workforce retraining.

2. Ethical Challenges: Concerns about data privacy and AI decision-making maturity.

3. Geopolitical Tensions: Dominance in AI could exacerbate global tensions, with technology becoming a new frontier in international relations.

Looking Ahead: What’s Next for Nvidia and AI?

What are society’s responsibilities in aligning technological advancements with ethical considerations? How can economies ensure they benefit equitably from AI growth? As Nvidia continues to shape the future, these questions beckon critical discourse.

Interesting Facts and Controversies

– Just as Nvidia benefits from AI’s growth, it faces intense competition from tech giants like AMD and Intel, vying for supremacy in AI chip technology.

– The infamous debate persists: Does Nvidia have an over-reliance on its AI sector, and is this diversification strategy sustainable?

For those keen on understanding more about technology’s transformative role, check out link name for deeper insights into Nvidia’s innovations.

Nvidia’s journey isn’t just about stock performance; it’s a bellwether for technological and economic shifts worldwide, presenting opportunities and challenges that we must navigate thoughtfully.