November has been a whirlwind for the financial markets, with significant events such as the U.S. presidential election and a Federal Reserve’s rate cut. As the month progresses, Nvidia prepares to take center stage with its third-quarter earnings report, scheduled for release on November 20. This report is particularly crucial for those watching trends in the semiconductor industry.

As we anticipate Nvidia’s upcoming earnings report, investors are eager to see whether Nvidia can sustain its impressive growth trajectory in the AI sector. Within the powerful group dubbed the “Magnificent Seven,” Nvidia remains the only major player yet to disclose its latest earnings, which adds an element of suspense to its upcoming announcement.

Historically, Nvidia’s stock has experienced significant price fluctuations around the time of earnings releases. For instance, in just the first two weeks of November, Nvidia shares soared by 8%, suggesting a palpable excitement in the market. Investors hope this trend continues following the earnings announcement.

Nvidia’s forward-looking guidance is anticipated to weigh heavily on investor sentiment. Central to these expectations is the upcoming launch of its highly-anticipated Blackwell GPU architecture. Speculation is rife with expectations of staggering demand—some forecasts even predict $10 billion in sales for the new chipsets within the year.

However, Nvidia’s supply chain dynamics are under scrutiny, given recent disruptions with partner Super Micro Computer. Investors are cautious, as potential supply chain issues could hinder short-term growth. Ultimately, while there is optimism, it’s advised that investors exercise prudence and consider potential volatility following the earnings release.

Nvidia’s Next Leap: How It Shapes Our Tech Landscape and Lives

As the markets buzz with anticipation ahead of Nvidia’s third-quarter earnings report, set for November 20, intriguing details have emerged that could significantly impact our understanding of the semiconductor industry and beyond. The underlying implications of Nvidia’s financial health aren’t confined to investors alone; they ripple through our everyday lives, alter community interactions, and even influence global economies.

Interesting Facts and Controversies

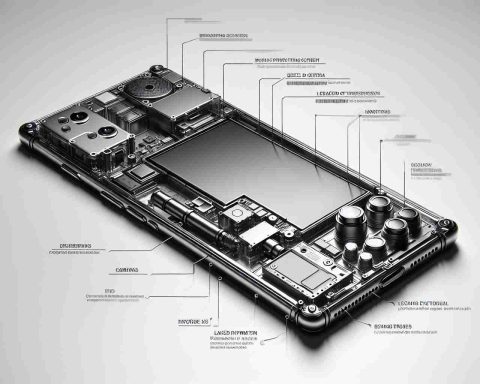

Nvidia is not just another tech company. It’s a titan in the artificial intelligence (AI) and graphics processing unit (GPU) markets, pushing the boundaries of what’s possible in computing. Yet, with great power comes substantial scrutiny. As Nvidia plans to unveil its new Blackwell GPU architecture, excitement is sky-high. However, this development isn’t without its controversies. There are concerns about power consumption and environmental impacts given the energy-intensive nature of cutting-edge GPUs. As we move toward greener technologies, how Nvidia balances innovation with environmental responsibility will be a point of contention.

Impact on Lives and Economies

In terms of everyday impact, Nvidia’s advancements are set to enhance everything from video gaming experiences to AI applications like machine learning and data analytics. This technology could improve how businesses operate by enabling more efficient data processing and analysis. Communities leveraging AI for smart city initiatives may find Nvidia’s innovations integral to enhancing public services such as traffic management, energy consumption, and security systems.

Globally, Nvidia’s potential $10 billion revenue from its new chipsets could influence industrial growth and economic policies in semiconductor-reliant countries. As such, nations are keen to secure a stake in Nvidia’s supply chain and distribution network, which can lead to geopolitical negotiations around tech trade agreements.

Advantages and Disadvantages

The advantages of Nvidia’s technological progression are clear: enhanced computing power facilitates breakthroughs in science, medicine, and infrastructure. Nevertheless, disadvantages lie in the possible over-dependence on Nvidia’s technology, leading to market monopolization and stifled competition. Also, if Nvidia faces supply chain disruptions, as recently seen with partner Super Micro Computer, there could be notable repercussions on production timelines and product availability, affecting both companies and consumers.

Pressing Questions and Thoughtful Answers

How does Nvidia influence local communities?

Nvidia’s technology has the potential to transform local economies. By enabling local businesses to adopt AI solutions, NVIDIA fosters growth and efficiency, which could lead to job creation in new tech sectors. For example, local startups focused on AI applications gain a competitive edge using advanced Nvidia GPUs, driving innovation and community development.

Could Nvidia’s dominance in the AI sector pose risks?

Yes, it might. While Nvidia’s leadership accelerates tech advancements, it also poses risks of market monopolization, where competition diminishes, potentially driving prices up and innovation down. Balancing regulatory oversight and fostering competition will be essential to maintain a healthy market landscape.

For those interested in learning more about the semiconductor industry and AI technology, visit Nvidia’s official website. Here, updates on their technological innovations and corporate strategies are regularly shared, providing a deeper understanding of their impact and trajectory in the tech world.