In a remarkable turn of events, Apple Inc. (NASDAQ:AAPL) shares managed to inch upwards on Thursday despite turbulence across the broader stock market. This comes amid mounting legal challenges as a major UK-based consumer group has initiated a colossal £3 billion claim, accusing Apple of breaching competition laws with its iCloud service.

Meanwhile, investment circles are abuzz with news concerning Warren Buffett’s Berkshire Hathaway Inc. (NYSE:BRK). The financial conglomerate has recently reduced its holdings in Apple, slashing their stake from 400 million to 300 million shares. This represents a substantial reduction in their investment in the tech giant, which commenced in earnest in Q3 2023.

Against the backdrop of these developments, Apple’s dividend yield offers an intriguing proposition for investors seeking regular income. Currently, Apple pays an annual dividend yield of 0.44%, translating to a quarterly payout of 25 cents per share, totaling $1.00 annually.

For investors aiming to generate $500 each month purely from Apple’s dividends, significant capital would be necessary. An investment approaching $1,369,320, or roughly 6,000 shares, would achieve this goal. On a more accessible scale, those wanting $100 per month would need about $273,864 invested, corresponding to around 1,200 shares.

Such calculations depend heavily on the stability of Apple’s current dividend rate and stock price, both of which can fluctuate. Investors are advised to remain vigilant, especially as economic conditions and company decisions evolve over time.

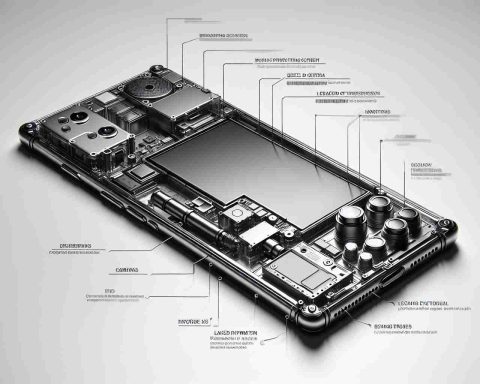

Unveiling the Hidden Layers of Apple’s Empire: What Lies Beneath the Surface?

The world’s fascination with Apple Inc. goes beyond its sleek devices and innovative software. While recent headlines have focused on legal challenges and investment maneuvers, there are several intriguing dimensions to Apple’s empire that often go unnoticed, yet significantly impact economies and communities globally.

Environmental Impact of Apple’s Supply Chain

Apple’s influence extends into environmental territories, where the company’s supply chain decisions ripple across the globe. From massive factories in China to rare earth mining linked to tech production, Apple’s operations profoundly impact environmental sustainability.

Advantage: Apple has made strides in enhancing its environmental policies, pledging to become 100% carbon neutral for its supply chain and products by 2030. Its focus on renewable energy and sustainable materials sets a benchmark in the industry, encouraging others to follow suit.

Disadvantage: However, critics argue that despite these efforts, the scale of production and resource extraction linked to Apple continues to deplete local environments and communities, particularly in regions with less stringent regulations.

Social Equity and Labor Practices

The global reach of Apple also raises significant labor and social equity questions. Factories producing Apple products have faced scrutiny over working conditions, worker rights, and fair wages.

Controversy: Human rights organizations have often highlighted concerning labor practices in some of Apple’s supply chain factories. Audits reveal issues such as excessive overtime, inadequate break times, and insufficient safety measures.

Question: Does buying an Apple product implicitly endorse these practices? While it’s not a straightforward answer, consumers and advocates have the power to pressure Apple for transparency and ethical labor practices through informed purchasing decisions and activism.

Economic Influence and Global Markets

Apple’s financial strategies and market positioning significantly affect global economies. Countries hosting Apple’s major operations receive boosts in job creation and infrastructure, yet face the challenges of economic dependency on a single corporation.

Advantage: Apple’s presence in developing economies facilitates technology transfer, upskills local labor, and opens markets to international trade.

Disadvantage: On the flip side, economies overly reliant on Apple’s investments can suffer if the company chooses to relocate, leaving behind economic vacuums.

Ride the Wave: Stock Market Influence

Apple’s actions heavily sway the stock market, both directly and indirectly. A rise in Apple stock often leads to a market uptick, dubbed the “Apple Effect,” buoying investor confidence and influencing tech-related stocks.

Interesting Fact: Apple’s market moves can affect retirement funds and investment portfolios worldwide, given its position as a favored stock in numerous pension and index funds.

Final Thought and Ethics:

Is it ethical for one corporation to wield such influence? The dilemma lies in balancing corporate power with ethical responsibility and ensuring that Apple’s future growth is inclusive and sustainable. The company’s choices serve as a microcosm of tech’s broader role in shaping tomorrow’s world.

For more insights on Apple’s business strategies and ethical practices, visit Apple. For updates on investment trends and stock market influence, check Bloomberg.