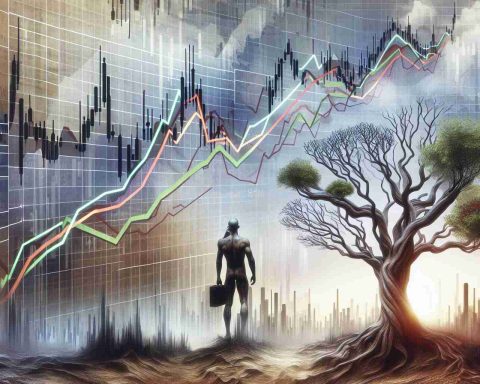

In an electrifying twist to the year, Samsung Electronics Co experienced an invigorating surge in its stock prices on Friday, marking its most impressive performance since January 2021. The market seems to be re-evaluating the South Korean tech giant as a compelling investment, particularly after several challenging months that left their marks on its stock value.

Samsung, renowned as the globe’s leading producer of memory chips and smartphones, saw its stock climb as high as 8.6%, effectively breaking a five-day streak of declines. This renewed investor interest persists even though the company’s shares have plunged nearly 32% this year. Factors contributing to earlier losses include apprehensions about Samsung’s position in the artificial intelligence sector and concerns about the impact of aggressive trade policies from figures such as Donald Trump.

Experts have indicated that the surge could partly result from technical aspects. Daiwa Securities analyst SK Kim explained that the stock bounced back from a dip below the 50,000 won mark (approximately US$35.70), a price point seen as important for investor confidence. By midday, shares stabilized at 53,800 won, reflecting more than a 10% discrepancy from their predicted value for the upcoming year’s financial outlook.

While the surprising rebound paints a hopeful picture for some, challenges still loom. Certain analysts, including Sat Duhra from Janus Henderson Group, suggest that Samsung’s current valuation is fitting due to persistent trade threats and the gradual recovery needed in the high bandwidth memory sector. For some investors, opportunities might lie elsewhere, particularly in Taiwan’s tech market.

Tech Stocks in Focus: The Ripple Effect of Samsung’s Market Resurgence

Samsung Electronics Co.’s recent surge in stock prices has sparked intriguing discussions across global markets, challenging analysts and investors to reassess not only Samsung’s future but the broader impact on industries and countries worldwide. While the spotlight has centered on Samsung, other factors and players are quietly shifting the dynamics of the tech world, affecting lives, communities, and economies in unexpected ways.

Interesting Facts and Controversies

Samsung’s leap in stock prices comes amidst an intriguing backdrop where tech giants across the globe are facing increased scrutiny and competition. While many focus on the headlines capturing Samsung’s stock rebound—an 8.6% hike breaking a five-day losing streak—an underlying story is the intense competition in the semiconductor and smartphone industry. Companies in Taiwan, particularly in the semiconductor market, continue to flourish, providing a strong competitive edge that could reshape the global tech landscape.

Controversies also surround Samsung’s position in the artificial intelligence market. Skeptics question whether the company is positioned effectively to lead future advancements, drawing comparisons with leading tech innovators in Silicon Valley and China. This division highlights a broader debate on how companies should adapt in a rapidly evolving industry set against the backdrop of geopolitical tensions and trade policies.

Advantages and Disadvantages

The stock surge for Samsung offers several advantages. It boosts investor confidence and potentially paves the way for increased investment in research and development, especially in artificial intelligence and semiconductor technologies. Such advancements may lead to innovations that improve the quality of life through smarter, more efficient technology.

However, there are disadvantages to consider. Any volatility in stock prices can have ripple effects, unsettling markets wary of instability. Additionally, Samsung’s challenges in the artificial intelligence sphere could either prompt swift innovation or result in delays, affecting technological progress and market dynamics globally.

Impact on People and Communities

How does this affect everyday lives? For communities, especially those reliant on Samsung’s extensive supply chain, a stable company means economic security. Jobs tied to the production and distribution of semiconductors and smartphones remain safeguarded. Conversely, should Samsung face setbacks, the economic repercussions could extend to layoffs and economic downturns in regions heavily dependent on its operations.

Questions and Answers

– What does Samsung’s rebound mean for the tech industry?

– Samsung’s rebound provides a signal of potential growth and stability, encouraging investors and other tech companies to pursue innovation amidst uncertainty.

– How might this affect global trade dynamics?

– It might influence global trade dynamics by shifting investment interest between regions, reflecting broader industry confidence or skepticism.

– Is it a good time to invest in tech stocks beyond Samsung?

– While Samsung’s success suggests potential in tech investments, factors like geopolitical tensions, market competition, and individual company strategies should guide broader investment decisions.

As Samsung navigates this turn in fortune, stakeholders globally are watching closely. The effects of its success—or any future missteps—could extend far beyond stock portfolios.

For further reading on global tech and trade dynamics, consider exploring related domains such as CNBC’s main page and Financial Times’ main domain.