Micron Technology (NASDAQ:MU) experienced a modest rise in share price during Thursday’s trading, as stocks increased by 1.1%. The company saw its shares reach a peak of $102.29 before settling at $101.00, amidst a significant 77% drop in trading volume compared to the norm. This upward tick follows a prior close at $99.92.

Analyst Insights and Predictions

A number of influential research analysts have been updating their insights on Micron Technology. KeyCorp recently revised their price target for the company downwards from $145.00 to $135.00, maintaining an “overweight” status. Similarly, Needham & Company LLC reasserted a “buy” rating with a robust $140.00 target. In contrast, BNP Paribas downgraded the stock to “underperform,” slashing their target to $67.00.

Bank of America remains optimistic, elevating their price objective to $125.00 and supporting a “buy” rating. Despite varied opinions, MarketBeat data reveals a consensus rating of “Moderate Buy,” with a general target of $143.04.

Financial Performance and Growth

Micron recently reported earnings of $1.18 per share for the quarter, surpassing predictions by $0.21. Revenues reached $7.75 billion, a 93.3% surge from last year. Analysts predict Micron will achieve earnings of 8.31 per share this fiscal year.

Investors and Market Movements

In addition to significant stockholder movements, high-profile institutional investors, including Vanguard and Primecap Management, have adjusted their stakes. These shifts reflect the broader investment community’s strategic reassessment of Micron’s market position.

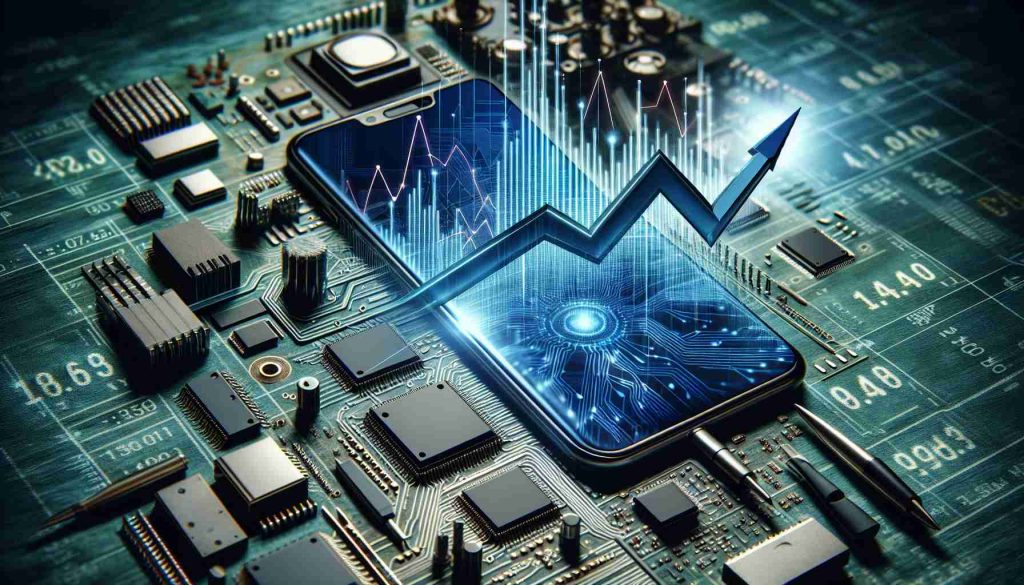

Micron Technology continues to make waves in the semiconductor industry, offering advanced memory and storage solutions essential for modern computing needs.

The Silent Revolution: How Micron Technology’s Innovations Are Reshaping Our Digital World

Micron Technology, a pivotal player in the semiconductor industry, is not just witnessing fluctuations in stock prices and analyst ratings; its cutting-edge innovations are profoundly impacting global industries and everyday life. As the need for faster, more efficient data storage and processing accelerates, Micron’s contributions are becoming increasingly vital.

Innovative Contributions to Everyday Life

Micron is at the forefront of developing DRAM and NAND flash memory technologies, which are integral to the modern digital experience. This impact stretches beyond individual consumers to entire sectors, from healthcare to autonomous vehicles. The advent of 5G technology and the evolution of artificial intelligence (AI) are particularly reliant on advanced memory solutions. As devices become “smarter,” the demand for robust, efficient memory technologies like those developed by Micron is skyrocketing.

Advantages of Micron’s Advances

1. Enhanced Performance in Consumer Electronics: Micron’s innovations enable faster processing speeds and greater device efficiency, benefiting everything from smartphones to laptops.

2. Support for AI and Machine Learning: Improved memory solutions allow for rapid data processing, essential for AI applications in industries such as healthcare, where real-time data analysis can be life-saving.

3. Boost to Autonomous Vehicles: The automotive industry stands to gain tremendously, with enhanced memory chips enabling better data handling for autonomous vehicle operations, promoting safer and more reliable transportation.

Controversies and Challenges

While Micron is charting a path forward with innovative solutions, challenges persist. Environmentally, the semiconductor industry faces scrutiny over its energy consumption and resource use. Addressing these sustainability challenges is crucial as demand continues to grow.

Critics argue that the company’s aggressive expansion and the broader tech industry’s push for “smarter” devices can contribute to e-waste and exacerbate the digital divide, where only wealthier nations benefit from technological advancements.

Key Questions and Insights

– How is Micron addressing sustainability concerns?

Micron is actively investing in sustainable practices, aiming to reduce its carbon footprint through cleaner production methods and more efficient designs. Incorporating recycling into their processes is a top priority.

– Will Micron’s growth continue at the current rate?

With the rapid evolution of AI, IoT, and mobile technology, the demand for advanced memory solutions is unlikely to wane soon. However, maintaining growth will require navigating geopolitical challenges and supply chain issues, especially given the semiconductor supply shortages experienced globally.

The Future Landscape

Looking ahead, Micron’s role in shaping the technology landscape will likely expand further, with potential partnerships in quantum computing and biotechnology sectors. Investors and stakeholders must weigh these prospects against existing challenges to forecast the company’s true trajectory.

For those interested in a deeper dive into Micron Technology’s dynamic role in the digital age and its investments in sustainability, consider visiting the following resources:

The dialog about technology’s role in shaping our future continues, highlighting both opportunities and responsibilities for industry leaders like Micron Technology.