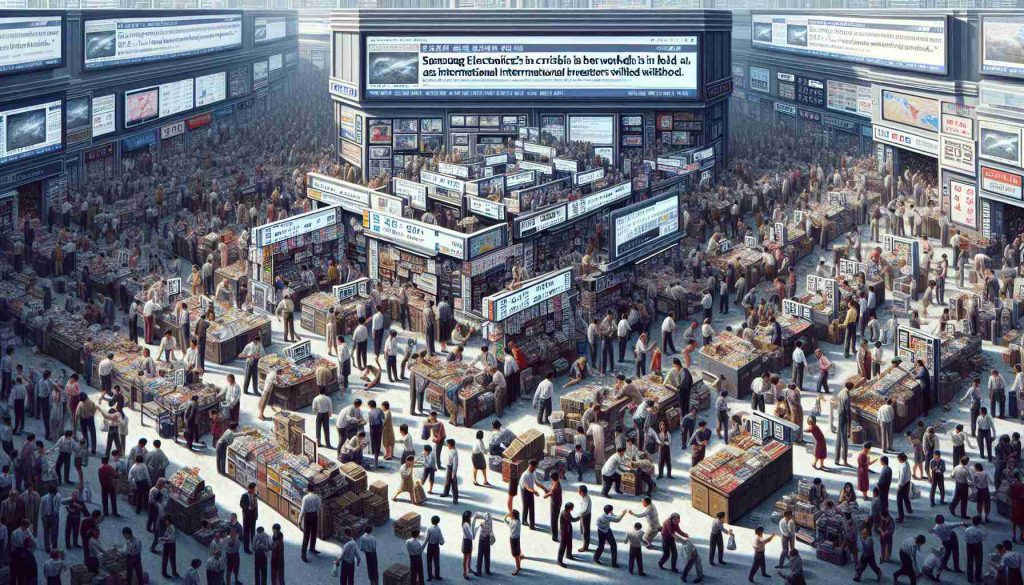

Shares of Samsung Electronics dipped to their lowest in over four years, reflecting growing concerns among investors. The decline comes as the U.S., under the Trump administration, considers implementing tariffs that could heavily impact the tech industry. Samsung, a leading name in the memory chip market, has been outpaced by other global chipmakers this year, notably Taiwan’s TSMC and the American company Nvidia, who have capitalized on the surging demand for artificial intelligence technology.

The primary concern for Samsung stems from its heavy reliance on Chinese consumers. Analysts highlight that U.S. tariffs targeting Chinese imports are likely to hit Samsung harder than its local competitor, SK Hynix. On the other hand, SK Hynix has been strengthening its position by focusing on high-end AI server chips, particularly catering to U.S. companies like Nvidia.

Amidst these challenges, Trump’s proposal of a universal 10% tariff on imports with an additional 60% on Chinese goods poses a significant threat. Experts from Hyundai Motor Securities suggest that such tariffs would dampen the demand for electronic products, directly affecting chip sales.

Adding to these economic tensions, South Korea’s President has expressed worries that the steep tariffs could push Chinese companies to lower their export prices, potentially eroding the global standing of Korean chip firms. As a result, Samsung’s stock has fallen by 34% this year, headed for its worst annual performance in decades, whereas SK Hynix has seen a 32% increase, and Nvidia’s shares have surged an impressive 199%.

Global Tech Tensions: How Trade Tariffs are Reshaping the Semiconductor Landscape

Introduction

In the fast-evolving world of technology, trade policies are becoming as impactful as innovation. While the semiconductor industry is the lifeblood of modern electronics, recent trade dynamics are reshaping its landscape in unexpected ways. Beyond the immediate concerns of companies like Samsung Electronics, broader ramifications are unfolding across industry and geopolitics.

Impacts on Communities and Industries

The ripple effects of tariffs can cascade through entire supply chains, affecting local communities, workers, and industries globally. For regions like South Korea, heavily reliant on semiconductor exports, these trade tensions can lead to economic instability. Communities that depend on Samsung and similar tech giants for employment face uncertain futures, while related industries, such as consumer electronics and telecommunications, may experience disrupted operations.

The semiconductor industry’s shift also poses challenges and opportunities for countries investing heavily in R&D and innovation. With companies like Nvidia and TSMC seizing market share, their home countries, including the United States and Taiwan, may find themselves at an advantage in the tech race, attracting more talent and capital investment.

Controversies and Critical Questions

These trade tensions raise several pertinent questions and controversies. For instance, how will this shift in power influence global technology standards? The reliance on American and Taiwanese chip leaders might prompt a change in global tech regulations or accelerate regional tech alliances, potentially sidelining firms like Samsung.

Furthermore, the role of government policies in economic landscapes becomes a topic of heated debate. Are tariffs the most effective tool for addressing trade imbalances? While they might protect certain domestic industries, tariffs also risk igniting retaliatory measures, sparking trade wars with long-lasting and unforeseen global consequences.

Advantages and Disadvantages of Current Policies

The introduction of universal tariffs has its own set of advantages and disadvantages. On the positive side, such policies might encourage domestic companies to innovate and reduce reliance on foreign imports, potentially leading to job creation within the country imposing the tariffs. However, the disadvantages often overshadow these benefits. Higher prices for imported goods can lead to increased production costs, resulting in more expensive consumer products. For the semiconductor industry, this could slow down the advancement and adoption of cutting-edge technologies, putting the brakes on innovation.

What Lies Ahead?

Will Samsung rebound or will its decline spur new tech champions? How can countries ensure the sustainability of their tech sectors amidst such global uncertainties? The answers are complex and multifaceted. The industry’s future may well depend on the delicate balancing act between protectionist policies and global cooperation.

For more insights and developments in the tech and semiconductor industries, follow reliable sources such as BBC, Bloomberg, and CNBC. These avenues provide comprehensive analysis and updates that can help industry watchers keep their fingers on the pulse of these critical changes.

In conclusion, while current trade policies and tariffs pose challenges, they also pave the way for industries to evolve strategically. The tech world waits with bated breath to see how these dynamics will shape the future of global innovation and economic stability.